The integration of YubiKey with banking services offers a layer of security that traditional passwords simply cannot match. For Chase Bank, a leader in financial services, adopting such advanced security measures is essential to maintaining customer trust and safeguarding sensitive financial data. Understanding whether this bank supports YubiKey and how it can benefit customers is crucial for those looking to enhance their online banking security. In this comprehensive guide, we will delve into the specifics of YubiKey, explore its compatibility with Chase Bank, and provide insights into how this integration can bolster your online banking security. We'll also address common questions, offer practical advice, and explore the broader implications of using hardware authentication devices in the financial sector.

| Table of Contents |

|---|

| 1. What is YubiKey? |

| 2. How Does YubiKey Work? |

| 3. Why Choose YubiKey for Online Security? |

| 4. Does Chase Bank Support YubiKey? |

| 5. How to Set Up YubiKey with Chase Bank? |

| 6. Benefits of Using YubiKey with Chase Bank |

| 7. Potential Challenges and Solutions |

| 8. Comparing YubiKey with Other Authentication Methods |

| 9. Real-life Scenarios: YubiKey in Action |

| 10. The Future of Banking Security |

| 11. FAQs |

| 12. Conclusion |

1. What is YubiKey?

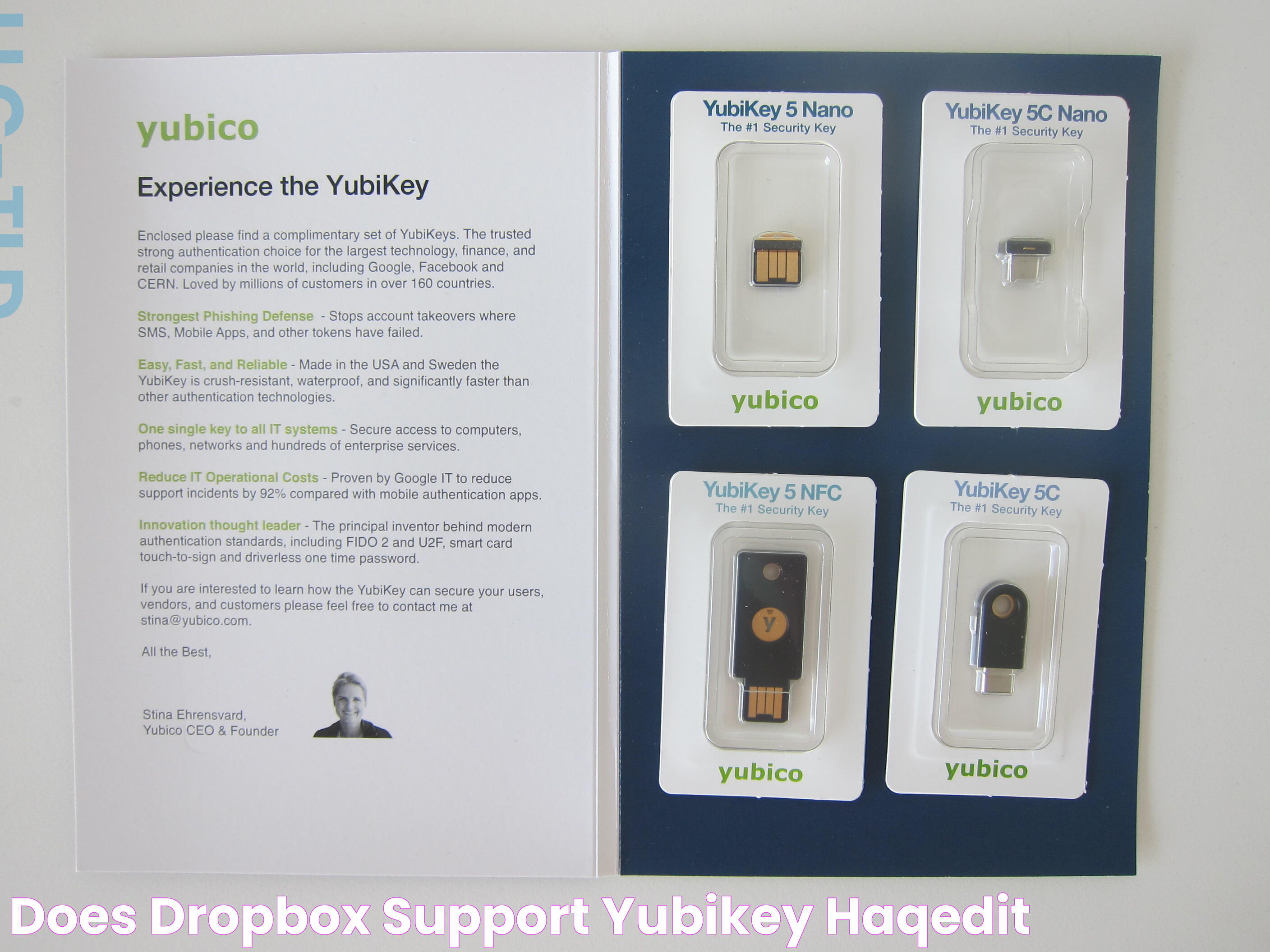

YubiKey is a hardware authentication device produced by Yubico, designed to provide secure access to computers, networks, and online services. Unlike traditional password-based systems, YubiKeys use two-factor authentication (2FA) to verify user identities, significantly reducing the risk of unauthorized access.

YubiKey works by generating a unique, one-time code that is used in conjunction with the user's password. This ensures that even if a password is compromised, the account remains secure as the YubiKey is required for access. The device is versatile and can be used with a variety of systems, making it a popular choice for both individuals and organizations looking to bolster their cybersecurity measures.

Read also:Mastering The Art Of Alto Saxophone Music A Harmonious Guide

Key Features of YubiKey

- Multi-protocol support: Compatible with a wide range of authentication protocols including FIDO U2F, OTP, and PIV.

- Water and crush resistant: Built to withstand harsh conditions, ensuring durability and reliability.

- Cross-platform compatibility: Works with Windows, macOS, Linux, and a variety of browsers and applications.

2. How Does YubiKey Work?

The operation of YubiKey is based on two-factor authentication, which requires two elements for user verification: something you know (a password) and something you have (the YubiKey device). This combination provides an added layer of security compared to password-only systems.

Step-by-Step Authentication Process

- User enters their username and password on the login page of a supported service.

- Once the password is verified, the system prompts the user to insert their YubiKey into a USB port or tap it on a device with NFC capability.

- The YubiKey generates a unique, one-time passcode that is sent to the authentication server for verification.

- If the passcode is correct, the user is granted access to the service.

Security Advantages

YubiKey's security advantages lie in its ability to provide a physical token that cannot be easily duplicated or hacked. The one-time passcodes are generated on the device itself, ensuring they cannot be intercepted or reused by malicious actors. Moreover, the use of a hardware device eliminates the threat of phishing attacks, as the passcodes cannot be entered on fraudulent websites.

3. Why Choose YubiKey for Online Security?

YubiKey offers several compelling reasons for individuals and organizations to enhance their online security strategies. Its robust authentication mechanism ensures that only authorized users can access sensitive information, significantly reducing the risk of data breaches.

Enhanced Protection Against Cyber Threats

With the rise of sophisticated cyber threats, relying solely on passwords is no longer sufficient. YubiKey's two-factor authentication provides an additional layer of security that is both user-friendly and highly effective. By requiring physical possession of the YubiKey, it ensures that even if passwords are compromised, unauthorized access is prevented.

Streamlined User Experience

YubiKey enhances the user experience by simplifying the authentication process. Users no longer need to remember complex passwords or undergo cumbersome verification processes. Instead, a simple tap or insertion of the YubiKey is all it takes to gain access, making it both convenient and secure.

4. Does Chase Bank Support YubiKey?

The question of whether Chase Bank supports YubiKey is a critical one for customers looking to enhance their online banking security. As of the latest updates, Chase Bank has not officially announced support for YubiKey as part of its two-factor authentication options. However, Chase Bank continues to explore innovative security solutions, and it's possible that future developments may include the integration of hardware authentication devices like YubiKey.

Read also:Horrific Cases Unveiling The Dark Side Of Humanity

Chase Bank's Current Security Measures

Chase Bank currently employs a range of security measures to protect its customers' financial information. These include multi-factor authentication options such as SMS verification codes and biometric authentication. While these methods offer substantial security, the addition of YubiKey could further enhance protection against unauthorized access.

Potential Benefits of YubiKey Integration

- Increased security against phishing attacks and password theft.

- Simplified login process with a single physical device.

- Improved user trust and confidence in online banking services.

5. How to Set Up YubiKey with Chase Bank?

While Chase Bank does not currently support YubiKey, the setup process for integrating YubiKey with online services typically involves a few straightforward steps. Should Chase Bank adopt YubiKey in the future, customers can expect a similar setup process.

General Setup Process for YubiKey

- Acquire a YubiKey device from an authorized retailer or directly from Yubico.

- Register the YubiKey with your chosen online service, following the service's instructions for two-factor authentication setup.

- Insert the YubiKey into the USB port or tap it on an NFC-enabled device when prompted during the authentication process.

- Complete the setup by verifying the YubiKey's one-time passcode as instructed.

Preparing for Future Integration

For customers interested in using YubiKey with Chase Bank, staying informed about the bank's security updates and potential integration announcements is essential. In the meantime, users can familiarize themselves with YubiKey's functionality by using it with other supported services, such as email accounts, social media platforms, and cloud storage services.

6. Benefits of Using YubiKey with Chase Bank

Should Chase Bank integrate YubiKey into its security offerings, customers can expect a range of benefits that enhance their online banking experience. The combination of YubiKey's robust security features and Chase Bank's comprehensive financial services would create a powerful synergy to protect sensitive information.

Improved Security and Peace of Mind

YubiKey's physical authentication device ensures that only authorized users with the device in hand can access their accounts. This significantly reduces the risk of unauthorized access and provides users with peace of mind knowing their financial information is secure.

Convenient and User-Friendly Access

YubiKey simplifies the login process by eliminating the need for complex passwords and multi-step verification processes. Users can enjoy seamless access to their accounts with a simple tap or insertion of the YubiKey, making online banking more convenient and efficient.

Building Trust and Confidence

By adopting cutting-edge security technologies like YubiKey, Chase Bank can strengthen its reputation as a leader in financial security. Customers are more likely to trust a bank that prioritizes their safety and invests in advanced authentication methods, leading to increased customer satisfaction and loyalty.

7. Potential Challenges and Solutions

While the integration of YubiKey with Chase Bank offers numerous benefits, it also presents potential challenges that must be addressed to ensure a smooth user experience.

Compatibility and Accessibility

One potential challenge is ensuring compatibility between YubiKey and various devices used by Chase Bank customers. To address this, Chase Bank may need to provide clear guidance on supported devices and offer solutions for users with older or incompatible systems.

User Education and Support

Introducing a new authentication method requires educating customers on its use and benefits. Chase Bank can offer comprehensive support resources, including tutorials, FAQs, and customer service assistance, to help users transition to YubiKey smoothly.

Managing Lost or Stolen YubiKeys

In the event of a lost or stolen YubiKey, users may face challenges accessing their accounts. To mitigate this risk, Chase Bank can implement backup authentication methods and provide guidance on securing accounts in such situations.

8. Comparing YubiKey with Other Authentication Methods

YubiKey is one of several authentication methods available to enhance online security. Comparing its features and benefits to other methods can help users make informed decisions about their security strategies.

YubiKey vs. Passwords

- YubiKey offers superior security by requiring physical possession of the device, whereas passwords are vulnerable to theft and phishing attacks.

- YubiKey eliminates the need for complex passwords, simplifying the login process for users.

YubiKey vs. SMS Verification

- SMS verification relies on the security of mobile networks, which can be compromised through SIM swapping attacks.

- YubiKey provides a more secure alternative by generating one-time passcodes on the device itself.

YubiKey vs. Biometric Authentication

Biometric authentication, such as fingerprint or facial recognition, offers convenience but may be less secure than YubiKey. Physical traits can be replicated or altered, while YubiKey's hardware-based security is more difficult to compromise.

9. Real-life Scenarios: YubiKey in Action

To illustrate the practical benefits of YubiKey, let's explore real-life scenarios where YubiKey has been successfully implemented to enhance security.

Case Study 1: Corporate Security

A large corporation adopted YubiKey to secure its internal systems and protect sensitive data. By requiring employees to use YubiKey for access, the company significantly reduced the risk of data breaches and improved overall security posture.

Case Study 2: Personal Online Security

An individual concerned about online privacy used YubiKey to secure email, social media, and financial accounts. With YubiKey, the user experienced greater peace of mind knowing their accounts were protected against unauthorized access.

Success Stories from YubiKey Users

- Improved security for online transactions and sensitive communications.

- Simplified login processes and reduced reliance on passwords.

- Increased confidence in the security of personal and professional data.

10. The Future of Banking Security

The integration of hardware authentication devices like YubiKey represents a significant step forward in the evolution of banking security. As cyber threats continue to evolve, financial institutions must adopt innovative solutions to protect their customers and maintain trust.

Emerging Trends in Authentication Technology

Future developments in authentication technology may include advancements in biometric security, artificial intelligence-driven threat detection, and enhanced encryption methods. These innovations will work in tandem with devices like YubiKey to create a more secure and user-friendly banking experience.

The Role of Financial Institutions

Financial institutions play a critical role in advancing security measures and ensuring customer safety. By adopting cutting-edge technologies and investing in robust security infrastructure, banks can stay ahead of emerging threats and provide customers with the highest level of protection.

Challenges and Opportunities Ahead

- Balancing security with user convenience and accessibility.

- Continuously adapting to new threats and vulnerabilities.

- Collaborating with technology providers to develop and implement effective security solutions.

11. FAQs

What is YubiKey and how does it work?

YubiKey is a hardware authentication device that uses two-factor authentication to enhance online security. It generates a unique, one-time passcode that, when used alongside a password, verifies user identity and provides secure access to online services.

Does Chase Bank support YubiKey for online banking?

As of the latest updates, Chase Bank has not officially announced support for YubiKey. Customers interested in using YubiKey should stay informed about potential future developments and integration announcements from the bank.

How can I set up YubiKey with my online accounts?

Setting up YubiKey involves registering the device with your chosen online service, inserting it into a USB port or tapping it on an NFC-enabled device, and completing the setup by verifying the generated passcode as instructed by the service.

What are the benefits of using YubiKey for online security?

YubiKey provides enhanced protection against unauthorized access, simplifies the login process, and reduces reliance on passwords. It is a convenient and user-friendly solution for individuals and organizations looking to improve their online security posture.

How does YubiKey compare to other authentication methods?

YubiKey offers superior security by requiring physical possession of the device, making it more secure than passwords and SMS verification. It is also more difficult to compromise than biometric authentication methods, which rely on replicable physical traits.

What should I do if I lose my YubiKey?

If you lose your YubiKey, it is important to secure your accounts by using backup authentication methods and contacting the relevant service providers for assistance. Keeping spare YubiKeys and storing them securely can help prevent disruptions in access.

12. Conclusion

The question of whether Chase Bank supports YubiKey highlights the broader issue of online banking security and the need for advanced authentication solutions. While Chase Bank has yet to officially integrate YubiKey, the potential benefits of such a partnership are clear. By adopting hardware authentication devices like YubiKey, financial institutions can enhance security, improve customer trust, and stay ahead of evolving cyber threats.

As we look to the future, the role of innovative security technologies in the financial sector will become increasingly important. Whether through the integration of YubiKey or other cutting-edge solutions, banks must continue to prioritize customer safety and invest in robust security measures to protect sensitive financial information.

In the meantime, individuals and organizations can take proactive steps to improve their online security by using YubiKey with supported services, staying informed about new developments, and advocating for enhanced security measures within the financial industry. By doing so, we can work together to create a safer and more secure digital landscape for all.