In an era where financial agility is paramount, Primo Personal Loans have emerged as a beacon of opportunity for individuals seeking to manage their financial needs effectively. Whether you're planning a dream vacation, consolidating debt, or addressing unexpected expenses, these loans provide a flexible and dependable solution. With competitive interest rates and a streamlined application process, Primo Personal Loans are designed to cater to a wide range of financial scenarios, ensuring you can meet your goals with ease.

Primo Personal Loans stand out in a crowded marketplace due to their customer-centric approach. They offer a variety of loan options tailored to suit different financial needs and credit profiles. The emphasis on transparency and flexibility makes them a preferred choice for those who seek not just a loan but a partner in their financial journey. With an easy online application and quick approval process, securing the funds you need has never been more convenient.

In this comprehensive guide, we will delve into the nuances of Primo Personal Loans, exploring everything from eligibility criteria to repayment options. You'll discover how these loans can be tailored to your needs and how to leverage them for maximum benefit. Join us as we navigate the intricate world of personal loans, ensuring you have all the information you need to make an informed decision that aligns with your financial aspirations.

Read also:Historical Significance And Future Prospects Of Third Temple Construction

Table of Contents

- What Are Primo Personal Loans?

- Features and Benefits

- How to Apply for Primo Personal Loans?

- Eligibility Criteria

- Understanding Interest Rates and Fees

- Repayment Options

- Tips for a Successful Loan Application

- Managing Your Loan Effectively

- Impact on Your Credit Score

- Common Mistakes to Avoid

- Customer Testimonials: Real-Life Experiences

- FAQs about Primo Personal Loans

- Conclusion

What Are Primo Personal Loans?

Primo Personal Loans are unsecured loans offered to individuals to help them meet various personal financial needs. These loans do not require collateral, which makes them accessible to a broader audience. The primary purpose of such loans is to provide borrowers with the flexibility to use the funds for a wide array of purposes, including but not limited to:

- Debt consolidation

- Home renovations

- Medical expenses

- Educational expenses

- Travel and vacations

Designed with customer convenience in mind, Primo Personal Loans are known for their quick processing times and competitive interest rates. Borrowers can choose the loan amount and repayment term that best fits their financial situation.

Features and Benefits

Primo Personal Loans come with a host of features and benefits that make them stand out in the competitive loan market. Here are some of the key attributes:

Flexible Loan Amounts

Borrowers can access a wide range of loan amounts, allowing them to borrow precisely what they need without overextending themselves financially.

Competitive Interest Rates

Primo Personal Loans offer interest rates that are competitive, ensuring affordability over the life of the loan. These rates vary depending on the borrower's creditworthiness and the loan term chosen.

Easy Application Process

The application process is straightforward and user-friendly, allowing borrowers to apply online from the comfort of their homes. The necessary documentation is minimal, and the process is designed to be quick and hassle-free.

Read also:Patricia Arkette The Multifaceted Persona And Her Unforgettable Impact

No Collateral Required

As an unsecured loan, Primo Personal Loans do not require borrowers to put up any assets as collateral, providing peace of mind and reducing risk.

Flexible Repayment Terms

Borrowers can choose from a variety of repayment terms, making it easier to manage monthly payments according to their financial situation.

How to Apply for Primo Personal Loans?

Applying for a Primo Personal Loan is a seamless process that can be completed online. Here’s a step-by-step guide:

- Visit the official Primo Personal Loans website and navigate to the loan application section.

- Fill out the application form with your personal and financial details. Ensure all information is accurate to avoid delays.

- Upload the necessary documents, such as proof of identity, income, and address.

- Submit the application and wait for a response. You will typically receive a decision within a few business days.

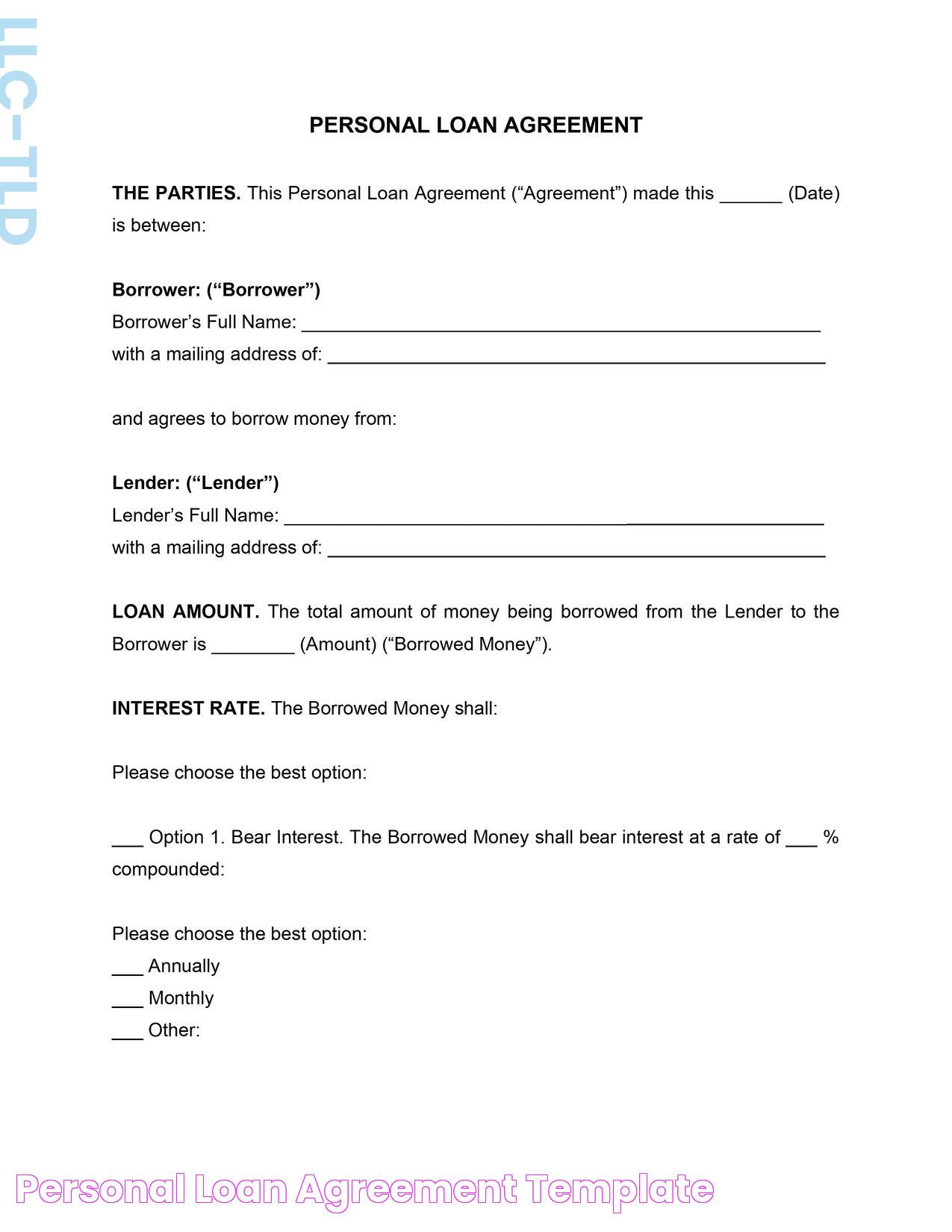

- If approved, review the loan agreement and terms. Sign the agreement electronically if you agree.

- Receive the funds in your account and start planning your expenses.

Eligibility Criteria

Before applying for Primo Personal Loans, it's important to understand the eligibility criteria. Meeting these requirements increases your chances of approval:

- Age: Applicants must be at least 18 years old.

- Income: A regular source of income is required to ensure repayment capability.

- Credit Score: While a good credit score enhances approval chances, Primo Personal Loans consider various credit profiles.

- Residency: Applicants must be residents of the country where the loan is offered.

Meeting these criteria is crucial, but lenders may also consider other factors such as employment history and existing financial obligations.

Understanding Interest Rates and Fees

Interest rates and fees are critical aspects of any loan, and Primo Personal Loans are no exception. Here's what you need to know:

Interest Rates

The interest rates on Primo Personal Loans are competitive, making them an affordable option for many borrowers. These rates are determined based on:

- The borrower's credit score

- Loan amount

- Repayment term

Borrowers with higher credit scores are often eligible for lower interest rates.

Fees

While Primo Personal Loans aim to keep fees to a minimum, there may be some charges associated with the loan, such as:

- Origination fees: A one-time fee for processing the loan application.

- Late payment fees: Charges incurred for missing payment deadlines.

Understanding these fees upfront ensures there are no surprises during the loan tenure.

Repayment Options

Primo Personal Loans offer a range of repayment options to accommodate different financial situations. Borrowers can choose from:

- Fixed monthly payments: Ensures consistent payments throughout the loan term.

- Flexible payment schedules: Allows borrowers to adjust payment dates according to their cash flow.

Primo Personal Loans also provide the option of early repayment without penalties, allowing borrowers to save on interest costs over the loan's duration.

Tips for a Successful Loan Application

To increase the chances of approval and secure the best terms, consider the following tips when applying for a Primo Personal Loan:

- Maintain a good credit score by making timely payments and reducing outstanding debt.

- Ensure all information provided in the application is accurate and up-to-date.

- Prepare all necessary documentation beforehand to avoid delays.

- Consider applying with a co-signer if your credit score is low.

Managing Your Loan Effectively

Effective loan management is key to avoiding financial stress and ensuring timely repayment. Here are some strategies to consider:

Create a Budget

Develop a monthly budget that includes your loan payments to ensure you can comfortably meet your financial obligations.

Set Up Automatic Payments

Consider setting up automatic payments to avoid missing due dates and incurring late fees.

Monitor Your Loan Balance

Regularly check your loan balance and payment history to stay informed about your progress.

Impact on Your Credit Score

Taking out a Primo Personal Loan can impact your credit score in various ways:

- Positive impact: Timely payments can improve your credit score over time.

- Negative impact: Missing payments or defaulting on the loan can adversely affect your credit score.

Understanding these impacts can help you make informed decisions and maintain a healthy credit profile.

Common Mistakes to Avoid

When applying for and managing a Primo Personal Loan, it's important to avoid common pitfalls such as:

- Borrowing more than you need, which can lead to unnecessary debt.

- Failing to read the loan agreement carefully, leading to misunderstandings about terms and conditions.

- Missing payments, which can result in late fees and damage to your credit score.

Customer Testimonials: Real-Life Experiences

Hearing from real customers can provide valuable insights into the benefits and challenges of Primo Personal Loans. Here are some testimonials from satisfied borrowers:

John Doe

"Primo Personal Loans helped me consolidate my debts into a single payment, saving me money on interest and reducing my financial stress."

Jane Smith

"The application process was straightforward, and I received the funds quickly. I'm grateful for the flexibility and support provided by Primo Personal Loans."

FAQs about Primo Personal Loans

What is the maximum loan amount I can borrow?

The maximum loan amount varies depending on your credit profile and financial situation. It's best to consult with a Primo Personal Loans advisor for specific details.

How long does it take to get approved?

Approval times can vary, but most applicants receive a decision within a few business days after submitting their application.

Can I pay off my loan early?

Yes, Primo Personal Loans allow for early repayment without penalties, helping you save on interest costs.

What happens if I miss a payment?

Missing a payment can result in late fees and may negatively impact your credit score. It's important to contact Primo Personal Loans if you're facing difficulties to explore possible solutions.

Do I need a good credit score to qualify?

While a good credit score increases your chances of approval, Primo Personal Loans consider various credit profiles and may offer options to those with less-than-perfect credit.

Are there any fees associated with Primo Personal Loans?

There may be fees such as origination fees and late payment charges. It's essential to review the loan agreement for a complete understanding of any applicable fees.

Conclusion

Primo Personal Loans offer a versatile and accessible financial solution for individuals seeking to manage their financial needs efficiently. By understanding the features, benefits, and potential pitfalls, borrowers can make informed decisions that align with their financial goals. Whether you're looking to consolidate debt, finance a major purchase, or cover unexpected expenses, Primo Personal Loans provide the flexibility and support needed to achieve your objectives with confidence.