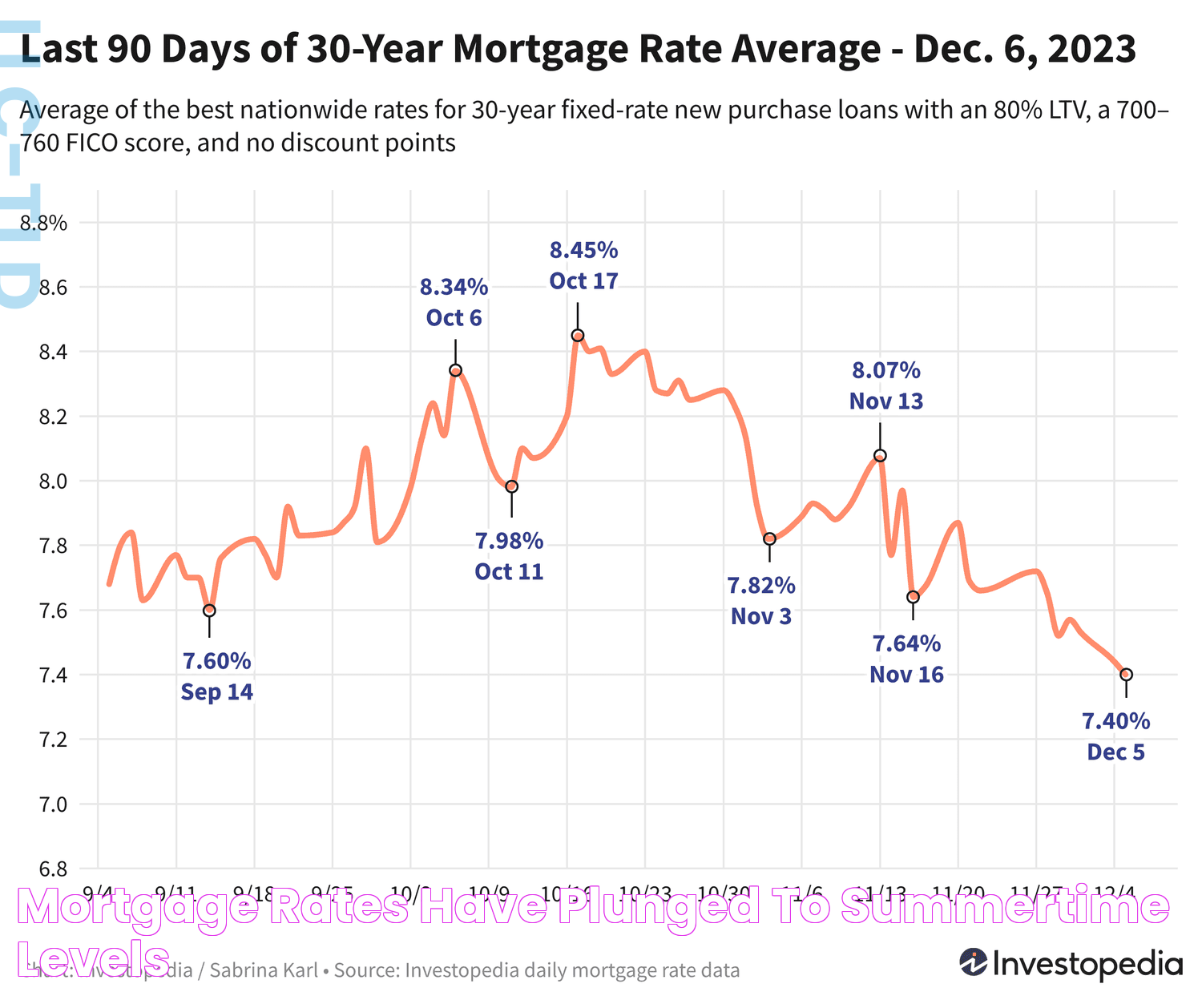

Mortgage rates plunged to their lowest levels since April 2023, creating a buzz among potential homebuyers and current homeowners alike. This unexpected dip in rates provides a golden opportunity for those looking to enter the housing market or refinance their existing loans. The fluctuation in mortgage rates can significantly impact monthly payments, overall loan costs, and the housing market at large.

Understanding the factors behind this decline can help consumers make informed decisions about their financial futures. Economic shifts, Federal Reserve policies, and global financial trends play a crucial role in determining mortgage rates. As these rates continue to fluctuate, it's important for consumers to stay informed about how these changes might affect them personally.

With mortgage rates at their lowest levels since earlier in the year, now may be a prime time to explore options in the housing market. Whether purchasing a new home or refinancing an existing mortgage, lower rates can lead to substantial savings over the life of a loan. In the following sections, we'll delve into the factors influencing these rates, the potential benefits for consumers, and expert tips for navigating the current mortgage landscape.

Read also:Introduction To Maplestar Jujutsukaisen And Its Intriguing World

Table of Contents

- Factors Influencing Mortgage Rates

- How Does the Federal Reserve Affect Mortgage Rates?

- The Impact of Global Economy on Mortgage Rates

- What Are the Benefits of Low Mortgage Rates?

- Should You Refinance Your Mortgage Now?

- Tips for Locking in Low Mortgage Rates

- How Mortgage Rates Affect Home Affordability

- The Role of Credit Score in Securing Low Rates

- How Does Loan Type Influence Mortgage Rates?

- Regional Variations in Mortgage Rates

- Mortgage Rates and the Housing Market

- The Future of Mortgage Rates

- Frequently Asked Questions

- Conclusion

Factors Influencing Mortgage Rates

Mortgage rates are influenced by a complex interplay of factors, both domestic and international. One of the primary determinants is the Federal Reserve's monetary policy, which can raise or lower rates to control inflation and stimulate economic growth. Other factors include economic indicators such as employment rates, GDP growth, and inflation data.

Furthermore, the global economic climate can also affect mortgage rates. For instance, geopolitical tensions, trade agreements, and international market conditions can lead to fluctuations in interest rates. The bond market is another critical factor, as mortgage rates often move in tandem with yields on long-term Treasury bonds. As these yields rise or fall, mortgage rates tend to follow suit.

How Does the Federal Reserve Affect Mortgage Rates?

The Federal Reserve, often referred to as the Fed, plays a pivotal role in shaping mortgage rates. By setting the federal funds rate, the Fed influences the borrowing costs for banks, which in turn affects the interest rates offered to consumers. When the Fed raises rates to combat inflation, mortgage rates typically increase. Conversely, when the Fed lowers rates to encourage borrowing and spending, mortgage rates tend to decrease.

In recent months, the Fed has adjusted its policies in response to various economic challenges, contributing to the current low mortgage rates. Understanding the Fed's policy decisions and their potential impact on mortgage rates can help consumers make informed financial choices.

The Impact of Global Economy on Mortgage Rates

The global economy plays a significant role in determining mortgage rates. Events such as trade negotiations, international conflicts, and economic growth in major economies can all influence interest rates worldwide. For example, uncertainty in global markets may lead investors to seek safer investments, such as U.S. Treasury bonds, driving down yields and, consequently, mortgage rates.

Additionally, central banks around the world may adjust their monetary policies in response to global economic conditions, indirectly affecting U.S. mortgage rates. By staying informed about global economic trends, consumers can better anticipate changes in mortgage rates and make strategic decisions about their home financing.

Read also:All About Cavinder Twins Fans S A Closer Look At Their Admirers

What Are the Benefits of Low Mortgage Rates?

Low mortgage rates offer numerous advantages for both homebuyers and existing homeowners. For first-time buyers, lower rates can make homeownership more affordable by reducing monthly mortgage payments. This can enable buyers to qualify for larger loans or purchase homes in more desirable areas.

Existing homeowners can also benefit from refinancing their mortgages at lower rates. Refinancing can lead to significant savings over the life of a loan, as reduced interest rates translate to lower monthly payments and less interest paid overall. Additionally, refinancing may provide opportunities to consolidate debt or tap into home equity for other financial needs.

Should You Refinance Your Mortgage Now?

With mortgage rates at their lowest levels since April 2023, many homeowners are considering refinancing their existing loans. Refinancing can be a smart financial move if it results in a lower interest rate, reduced monthly payments, or a shorter loan term. However, it's important to carefully evaluate the costs and benefits before making a decision.

Factors to consider include the remaining term of your current mortgage, the potential savings from refinancing, and any fees or closing costs associated with the new loan. Consulting with a financial advisor or mortgage professional can help you determine whether refinancing is the right choice for your specific situation.

Tips for Locking in Low Mortgage Rates

Securing the best mortgage rate requires careful planning and attention to detail. Here are some tips to help you lock in a favorable rate:

- Improve Your Credit Score: A higher credit score can result in better mortgage rates, so consider paying down debt and correcting any errors on your credit report.

- Shop Around: Compare offers from multiple lenders to find the most competitive rates and terms.

- Consider Different Loan Types: Fixed-rate and adjustable-rate mortgages have distinct advantages, so explore options to find the best fit for your financial goals.

- Stay Informed: Keep an eye on economic news and trends that may impact mortgage rates, and act quickly when rates dip.

How Mortgage Rates Affect Home Affordability

Mortgage rates have a direct impact on home affordability. Lower rates can make homeownership more accessible by reducing the monthly cost of a mortgage. This can enable buyers to qualify for larger loans and purchase homes in more desirable locations.

Conversely, higher mortgage rates can increase the cost of homeownership, potentially pricing some buyers out of the market. Understanding the relationship between mortgage rates and home affordability can help consumers make informed decisions about when to buy and how much to borrow.

The Role of Credit Score in Securing Low Rates

Your credit score plays a crucial role in determining the mortgage rates you're offered. Lenders use credit scores to assess the risk of lending to a borrower, with higher scores indicating lower risk. As a result, borrowers with strong credit scores are more likely to qualify for lower mortgage rates.

To improve your credit score, consider paying down debt, avoiding new credit inquiries, and ensuring that your credit report is accurate. By taking steps to boost your credit score, you can increase your chances of securing a favorable mortgage rate.

How Does Loan Type Influence Mortgage Rates?

The type of mortgage loan you choose can significantly affect the interest rates you're offered. Fixed-rate mortgages offer stability with consistent payments over the life of the loan, while adjustable-rate mortgages (ARMs) may start with lower rates that can fluctuate over time.

Each loan type has its advantages and disadvantages, so it's important to consider your long-term financial goals when choosing a mortgage. Discussing your options with a mortgage professional can help you determine the best loan type for your needs and secure the most competitive rates.

Regional Variations in Mortgage Rates

Mortgage rates can vary significantly by region, influenced by local economic conditions, housing market dynamics, and competition among lenders. Some areas may experience higher demand for housing, driving up rates, while others may see lower rates due to less competition.

Understanding regional variations in mortgage rates can help buyers and homeowners make informed decisions about when and where to purchase or refinance a home. By staying informed about local market conditions, consumers can take advantage of favorable rates in their area.

Mortgage Rates and the Housing Market

Mortgage rates are a key factor in the overall health of the housing market. Low rates can stimulate demand for homes, leading to increased sales and rising home prices. Conversely, higher rates may dampen demand, slowing sales and stabilizing prices.

Monitoring mortgage rate trends can provide valuable insights into the direction of the housing market and help consumers make strategic decisions about buying, selling, or refinancing a home.

The Future of Mortgage Rates

Predicting the future of mortgage rates is challenging, as they are influenced by a wide range of economic factors. However, understanding current trends and potential influences can help consumers anticipate changes and make informed decisions about their home financing.

As the economy continues to recover and evolve, mortgage rates may fluctuate in response to shifts in Federal Reserve policy, global economic conditions, and domestic economic indicators. Staying informed about these factors can help consumers navigate the ever-changing landscape of mortgage rates.

Frequently Asked Questions

What causes mortgage rates to change?

Mortgage rates change due to a combination of factors, including Federal Reserve policies, economic indicators, and global market conditions. These factors influence the cost of borrowing and the demand for loans, leading to fluctuations in interest rates.

How often do mortgage rates change?

Mortgage rates can change daily based on economic news, market trends, and lender competition. It's important for consumers to stay informed about rate changes to make timely decisions about their home financing.

What is the difference between a fixed-rate and an adjustable-rate mortgage?

A fixed-rate mortgage offers a consistent interest rate and monthly payment over the life of the loan, while an adjustable-rate mortgage (ARM) may start with a lower rate that can change periodically based on market conditions.

Can I refinance my mortgage with bad credit?

Refinancing with bad credit can be challenging, but it's not impossible. Some lenders offer refinancing options for borrowers with lower credit scores, though the rates may be higher. Improving your credit score before refinancing can help you secure better terms.

What is a mortgage rate lock?

A mortgage rate lock is an agreement between a borrower and lender to secure a specific interest rate for a set period. This can protect borrowers from rising rates while their loan is processed, though terms and fees may vary by lender.

How do I know if I'm getting the best mortgage rate?

To ensure you're getting the best mortgage rate, compare offers from multiple lenders, consider different loan types, and evaluate the terms and fees associated with each option. Working with a mortgage professional can help you navigate the process and secure a competitive rate.

Conclusion

The current environment, where mortgage rates plunged to their lowest levels since April 2023, offers unprecedented opportunities for potential homeowners and those looking to refinance. By understanding the factors that influence mortgage rates and staying informed about economic trends, consumers can make strategic decisions that benefit their financial futures.

Whether you're a first-time homebuyer or a seasoned homeowner, taking advantage of low mortgage rates can lead to significant savings and increased home affordability. By following expert tips and consulting with financial professionals, you can navigate the mortgage landscape with confidence and secure a loan that meets your needs and goals.

Stay proactive, stay informed, and seize the opportunities presented by these historically low mortgage rates to enhance your financial well-being and achieve your homeownership aspirations.