Finding the right car insurance for young drivers can be a daunting task, especially with the myriad of options available in the market. Young drivers often face higher premiums due to their lack of experience on the road, making it crucial to choose a policy that offers both value and adequate coverage. This comprehensive guide aims to simplify the process of obtaining the best car insurance for young drivers, helping you navigate through the complexities of insurance policies and find the one that best suits your needs.

In today's fast-paced world, young drivers are eager to hit the road and experience the freedom that comes with driving. However, with this freedom comes responsibility, particularly in the form of selecting the right car insurance. Understanding the nuances of different insurance options can significantly impact not only the cost but also the quality of coverage a young driver receives. This guide delves into the essential aspects of car insurance tailored for young drivers, offering insights into what factors to consider and how to secure the most favorable rates.

As young drivers embark on their driving journey, it's imperative to be well-informed about the various car insurance options available. From understanding the types of coverage to exploring discounts and tips for lowering premiums, this guide provides practical advice for young drivers and their families. By the end of this article, you'll have a clearer understanding of how to obtain the best car insurance for young drivers, ensuring peace of mind while navigating the open road.

Read also:Master The Art Of Cooking Frozen Ears Of Corn Simple Steps And Tips

Table of Contents

- Understanding Car Insurance

- Why Do Young Drivers Pay More for Car Insurance?

- Types of Car Insurance Coverage

- How to Choose the Best Car Insurance for Young Drivers?

- Factors Affecting Car Insurance Premiums

- What Discounts are Available for Young Drivers?

- Tips for Lowering Car Insurance Premiums

- Comparing Car Insurance Providers

- State-Specific Regulations

- Common Mistakes to Avoid

- Benefits of Comprehensive Coverage

- Importance of Reading the Fine Print

- Frequently Asked Questions

- Conclusion

Understanding Car Insurance

Car insurance is a contract between the driver and the insurance company that offers financial protection against losses resulting from accidents or other vehicle-related incidents. This protection covers a range of situations, from damage to your vehicle to liability for injuries caused to other people. The main purpose of car insurance is to mitigate the financial burden of unexpected events on the road.

Car insurance policies typically consist of several types of coverage, each designed to protect against specific risks. These include liability coverage, which pays for damages you cause to others; collision coverage, which pays for damage to your car from a collision; and comprehensive coverage, which covers non-collision-related damage such as theft or natural disasters. Understanding these coverage types is essential for young drivers seeking the best car insurance options.

It's important to note that car insurance requirements vary by state, with each state mandating a minimum level of coverage. Young drivers should familiarize themselves with their state's requirements to ensure they have adequate protection. Additionally, beyond the mandatory coverage, there are optional add-ons, such as roadside assistance or rental reimbursement, that can enhance the overall protection of the policy.

Why Do Young Drivers Pay More for Car Insurance?

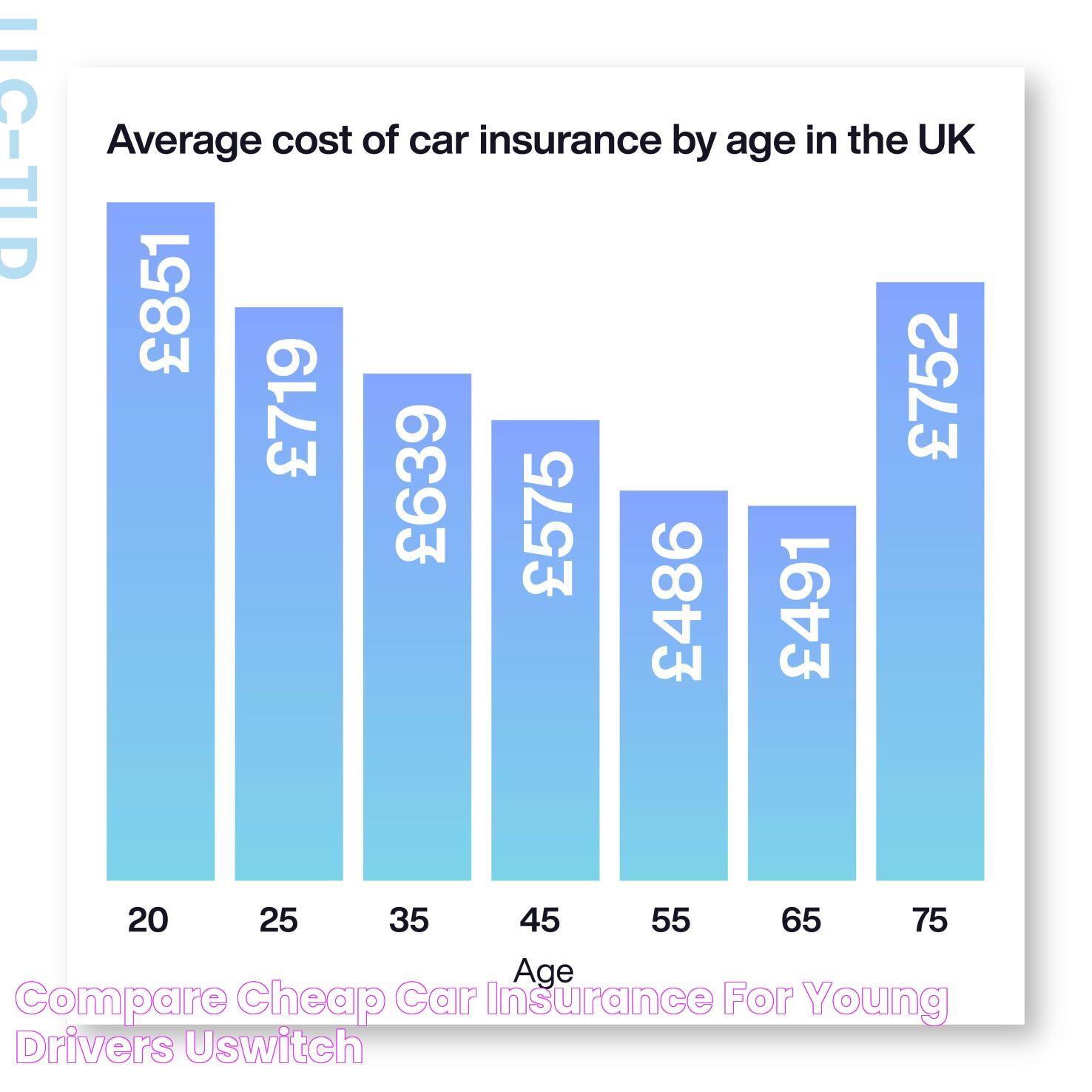

Young drivers often face higher car insurance premiums due to their perceived risk on the road. Insurance companies consider several factors when determining premiums, and age is a significant one. Statistics show that younger drivers, particularly those under 25, are more likely to be involved in accidents, leading insurers to charge higher rates to offset the increased risk.

Several reasons contribute to the higher risk associated with young drivers. Firstly, young drivers typically have less driving experience, making them more prone to mistakes and poor judgment. Secondly, young drivers are statistically more likely to engage in risky behaviors, such as speeding or using a mobile phone while driving, which increases the likelihood of accidents.

Insurance companies also consider the type of vehicle driven by young individuals. Sports cars or high-performance vehicles, which are often popular among younger demographics, tend to have higher premiums due to their potential for high-speed accidents. By understanding these factors, young drivers can take steps to mitigate their risk profile and potentially lower their insurance costs.

Read also:Things To Do In Big Bear Adventure Awaits In The Mountain Oasis

Types of Car Insurance Coverage

Car insurance policies offer various types of coverage, each serving a specific purpose. Understanding these coverage options is crucial for young drivers seeking comprehensive protection. The main types of car insurance coverage include:

- Liability Coverage: This is the most basic form of car insurance and is typically required by law. It covers damages and injuries you cause to others in an accident.

- Collision Coverage: This coverage pays for damages to your vehicle resulting from a collision with another vehicle or object.

- Comprehensive Coverage: Also known as "other than collision" coverage, this protects against non-collision-related incidents such as theft, vandalism, or natural disasters.

- Personal Injury Protection (PIP): PIP covers medical expenses and lost wages for you and your passengers, regardless of who is at fault in an accident.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you're involved in an accident with a driver who has insufficient or no insurance.

- Medical Payments Coverage: Similar to PIP, this covers medical expenses for you and your passengers, but does not include lost wages.

Young drivers should carefully consider these coverage types when selecting a policy. While liability coverage is mandatory, collision and comprehensive coverage are recommended for added protection, especially if the vehicle is relatively new or valuable.

How to Choose the Best Car Insurance for Young Drivers?

Selecting the best car insurance for young drivers involves evaluating various factors to ensure optimal coverage and value. Here are some steps to guide young drivers in choosing the right policy:

- Assess Your Needs: Consider factors such as your driving habits, the type of vehicle you drive, and your budget. This will help you determine the level of coverage you require.

- Research Insurance Providers: Look for companies with a strong reputation for customer service and financial stability. Reading reviews and seeking recommendations can provide valuable insights.

- Compare Quotes: Obtain quotes from multiple insurance providers to compare premiums, coverage options, and discounts available for young drivers.

- Review Coverage Options: Ensure the policy includes essential coverage types such as liability, collision, and comprehensive, along with any optional add-ons you may need.

- Check for Discounts: Many insurers offer discounts for young drivers, such as good student discounts or safe driving incentives. Inquire about these opportunities to reduce premiums.

- Understand Policy Terms: Read the policy terms and conditions carefully to understand what is covered and any exclusions or limitations that may apply.

By following these steps, young drivers can make informed decisions and select an insurance policy that provides the best protection and value for their specific needs.

Factors Affecting Car Insurance Premiums

Car insurance premiums for young drivers are influenced by a variety of factors, each contributing to the overall cost of the policy. Understanding these factors can help young drivers take proactive steps to manage their insurance costs effectively.

- Age and Experience: Younger, less experienced drivers are generally considered higher risk, leading to higher premiums.

- Driving Record: A clean driving record with no accidents or violations can result in lower premiums, while a history of accidents or traffic violations can increase costs.

- Type of Vehicle: Vehicles with high safety ratings and lower repair costs typically have lower premiums compared to high-performance or luxury vehicles.

- Location: Where you live can impact premiums due to factors such as traffic density, crime rates, and weather conditions.

- Coverage Levels: Higher coverage limits and additional coverage options can increase premiums but provide greater protection.

- Credit Score: In some states, insurers may consider credit scores when determining premiums, with higher scores often leading to lower rates.

Young drivers can potentially lower their insurance premiums by maintaining a clean driving record, choosing a safe and reliable vehicle, and exploring available discounts and incentives.

What Discounts are Available for Young Drivers?

Insurance companies often offer various discounts to help young drivers reduce their premiums. These discounts are designed to reward responsible driving behavior and encourage safe practices on the road. Some common discounts available for young drivers include:

- Good Student Discount: Many insurers offer discounts to students who maintain a certain GPA, as good academic performance is associated with responsible behavior.

- Driver's Education Discount: Completing a driver's education course can result in a discount, as it provides young drivers with valuable skills and knowledge.

- Safe Driver Discount: Maintaining a clean driving record without accidents or violations can qualify young drivers for safe driver discounts.

- Multi-Policy Discount: Bundling auto insurance with other policies, such as home or renters insurance, can lead to savings through multi-policy discounts.

- Usage-Based Discount: Some insurers offer discounts based on driving habits, using telematics devices to track safe driving behaviors.

- Pay-in-Full Discount: Paying the annual premium in full rather than in monthly installments can result in a discount.

Young drivers should inquire about these discounts when obtaining quotes from insurance providers, as they can significantly reduce the overall cost of car insurance.

Tips for Lowering Car Insurance Premiums

While young drivers may face higher insurance premiums, there are several strategies they can employ to lower their costs. Here are some practical tips for reducing car insurance premiums:

- Choose a Higher Deductible: Opting for a higher deductible can lower premiums, but be sure you can afford the out-of-pocket expense in case of a claim.

- Maintain a Clean Driving Record: Avoiding accidents and traffic violations can help keep premiums low.

- Install Safety Features: Installing safety features such as anti-theft devices or advanced driver assistance systems can qualify for discounts.

- Consider Usage-Based Insurance: Usage-based insurance programs track driving habits and can offer discounts for safe driving.

- Shop Around: Regularly compare quotes from different insurers to ensure you are getting the best rate.

- Bundle Policies: Bundle your auto insurance with other policies to take advantage of multi-policy discounts.

By implementing these strategies, young drivers can effectively manage their car insurance costs while maintaining adequate coverage.

Comparing Car Insurance Providers

With numerous car insurance providers available, young drivers should take the time to compare their options to find the best fit. Here are key factors to consider when evaluating insurance providers:

- Reputation: Research the company's reputation for customer service, claims handling, and financial stability.

- Coverage Options: Ensure the provider offers the coverage types and limits you need.

- Discounts: Look for providers that offer discounts for young drivers, such as good student or safe driver discounts.

- Pricing: Compare premiums and deductibles to find a policy that fits your budget.

- Online Tools: Consider the availability of online tools or mobile apps for managing your policy and filing claims.

- Customer Reviews: Read customer reviews and testimonials to gauge satisfaction with the provider.

By carefully comparing insurance providers, young drivers can make informed decisions and select a company that offers the best combination of coverage, service, and value.

State-Specific Regulations

Car insurance requirements and regulations vary by state, making it essential for young drivers to understand their state's specific mandates. Each state sets its own minimum coverage requirements, which drivers must meet to legally operate a vehicle. Failure to comply with these requirements can result in fines, license suspension, or other penalties.

Common state-specific regulations include:

- Minimum Liability Coverage: States typically require a minimum amount of liability coverage to cover bodily injury and property damage.

- No-Fault States: In no-fault states, drivers must carry personal injury protection (PIP) to cover their own medical expenses, regardless of fault.

- Uninsured/Underinsured Motorist Coverage: Some states mandate this coverage to protect drivers against accidents with uninsured or underinsured motorists.

- SR-22 Requirements: Drivers with certain violations may be required to file an SR-22 form, proving they have the required insurance coverage.

Young drivers should familiarize themselves with their state's regulations to ensure compliance and avoid potential penalties. Consulting with an insurance agent or visiting the state's department of motor vehicles website can provide valuable information on state-specific requirements.

Common Mistakes to Avoid

When selecting car insurance, young drivers should be aware of common mistakes that can lead to inadequate coverage or higher premiums. Here are some pitfalls to avoid:

- Choosing the Cheapest Policy: While cost is important, selecting a policy based solely on price can result in insufficient coverage.

- Overlooking Discounts: Failing to inquire about available discounts can result in paying more than necessary for coverage.

- Not Shopping Around: Sticking with the first quote received without comparing other options can lead to missed savings.

- Ignoring Policy Exclusions: Not understanding policy exclusions can lead to unexpected out-of-pocket expenses in certain situations.

- Underestimating Coverage Needs: Choosing minimum coverage limits may not provide adequate protection in the event of a serious accident.

By avoiding these common mistakes, young drivers can ensure they have the appropriate coverage and are not overpaying for their car insurance.

Benefits of Comprehensive Coverage

Comprehensive coverage provides valuable protection for young drivers, extending beyond accidents to cover a range of non-collision-related incidents. Here are some benefits of comprehensive coverage:

- Theft and Vandalism Protection: Comprehensive coverage protects against vehicle theft, vandalism, and damage from attempted theft.

- Weather-Related Damage: This coverage includes protection against damage from natural disasters, such as hurricanes, floods, and hailstorms.

- Animal Collisions: Comprehensive coverage pays for damage caused by collisions with animals, such as deer.

- Peace of Mind: Knowing you are covered for a wide range of potential incidents provides peace of mind for young drivers.

While comprehensive coverage may increase premiums, the added protection it offers can be invaluable, especially for young drivers with newer or more valuable vehicles.

Importance of Reading the Fine Print

When purchasing car insurance, young drivers must take the time to read the fine print of their policy documents. This ensures a clear understanding of coverage, exclusions, and terms that could impact claims or coverage levels.

Key aspects to review include:

- Coverage Limits: Confirm that the policy provides adequate coverage limits for your needs.

- Exclusions: Be aware of any exclusions that could result in denied claims.

- Deductibles: Understand the deductible amounts and how they affect claims payments.

- Policy Renewal Terms: Review renewal terms to anticipate potential changes in coverage or premiums.

- Claims Process: Familiarize yourself with the claims process to ensure a smooth experience if you need to file a claim.

By thoroughly reviewing the fine print, young drivers can avoid surprises and ensure they have a clear understanding of their car insurance policy.

Frequently Asked Questions

1. How can young drivers lower their car insurance premiums?

Young drivers can lower their premiums by maintaining a clean driving record, enrolling in driver's education courses, choosing a higher deductible, and taking advantage of available discounts such as good student or safe driver discounts.

2. Why is car insurance more expensive for young drivers?

Car insurance is more expensive for young drivers due to their lack of driving experience and higher likelihood of being involved in accidents. Insurers consider young drivers a higher risk, leading to increased premiums.

3. What is the best type of car insurance coverage for young drivers?

The best type of coverage for young drivers often includes liability, collision, and comprehensive coverage. These provide protection against a range of risks, from accidents to theft or natural disasters.

4. Are there specific discounts available for young drivers?

Yes, young drivers can take advantage of discounts such as good student discounts, driver's education discounts, and safe driver discounts. Inquiring about these can help lower insurance costs.

5. What factors affect car insurance premiums for young drivers?

Factors affecting premiums include age, driving record, type of vehicle, location, and coverage levels. Young drivers can manage costs by maintaining a clean driving record and choosing a safe vehicle.

6. How often should young drivers shop for car insurance?

It's advisable for young drivers to shop for car insurance annually or whenever there are significant changes in their circumstances, such as moving to a new location or purchasing a different vehicle, to ensure they are getting the best rate.

Conclusion

Securing the best car insurance for young drivers requires careful consideration of various factors, from understanding coverage types to exploring available discounts and managing premiums. By being informed and proactive, young drivers can navigate the complexities of car insurance and obtain a policy that offers both value and comprehensive protection. With the right coverage in place, young drivers can enjoy the freedom of the open road with confidence and peace of mind.