The weight of a company in the S&P 500 is determined by its market capitalization. This means that the larger the market capitalization of a company, the more influence it has on the index. This article aims to provide a detailed guide on the top S&P 500 companies by weight, helping you understand their role and significance in the stock market. By analyzing these companies, investors can make informed decisions and gain insights into the economic landscape. Moreover, the S&P 500 is a diversified index that covers various sectors, from technology and healthcare to consumer goods and finance. Each sector contributes differently to the index's performance, and companies within these sectors are weighted according to their market cap. This article will delve into the different sectors, highlighting the companies that hold the most weight and their contributions to the S&P 500 index.

Table of Contents

- What is the S&P 500 Index?

- How is Weight Determined in the S&P 500 Index?

- Why is Company Weight Important?

- Top S&P 500 Companies by Weight

- Sector Distribution of S&P 500 Companies

- How Do These Companies Impact the Stock Market?

- Apple Inc.: A Leader in Market Weight

- Microsoft Corporation: Powerhouse in Technology

- Amazon.com Inc.: Retail Giant's Influence

- Alphabet Inc.: The Parent of Google

- Meta Platforms: Social Media Titan

- What are the Benefits of Diversification in S&P 500?

- Strategies for Investors: Focusing on Weighted Companies

- Frequently Asked Questions

- Conclusion

What is the S&P 500 Index?

The S&P 500 Index, short for Standard & Poor's 500, is a stock market index that measures the stock performance of 500 large companies listed on stock exchanges in the United States. It is one of the most commonly followed equity indices and is considered a barometer for the overall health of the U.S. stock market. The index includes companies from all sectors, such as technology, healthcare, finance, and consumer goods, providing a comprehensive overview of the market.

The S&P 500 was created in 1957 by Standard & Poor's, a financial services company. Unlike the Dow Jones Industrial Average, which only includes 30 companies, the S&P 500 provides a broader perspective of the market by including 500 companies. It is weighted by market capitalization, meaning larger companies have more influence on the index's performance.

Read also:A Guide To Crisp And Juicy Perfecting The Art Of Flavorful Delights

Investors and analysts use the S&P 500 as a benchmark to measure the performance of individual stocks or investment portfolios. Since it includes a wide range of industries, it is often considered a reliable indicator of the U.S. economy's overall health. Changes in the index are closely monitored and can provide insights into market trends and investor sentiment.

How is Weight Determined in the S&P 500 Index?

The weight of a company in the S&P 500 index is determined by its market capitalization. Market capitalization, or market cap, is the total market value of a company's outstanding shares of stock. It is calculated by multiplying the current share price by the total number of outstanding shares.

In the S&P 500 Index, companies with higher market capitalization have a greater weight, meaning they have a more significant impact on the index's overall performance. For example, a company like Apple Inc., with a market cap of over $2 trillion, has a substantial influence on the index compared to smaller companies.

The index is rebalanced regularly to ensure that it accurately reflects the current market conditions. This involves adjusting the weights of the companies based on their market capitalization. Companies with declining market caps may see their weight reduced, while those with increasing market caps may see their weight increase.

Why is Company Weight Important?

The weight of a company in the S&P 500 index is important for several reasons:

- Influence on Index Performance: Companies with higher weight have a more significant impact on the index's performance. If a heavily weighted company experiences a sharp rise or fall in its stock price, it can cause the entire index to move accordingly.

- Indicator of Market Trends: The weight of a company can serve as an indicator of market trends. Companies with increasing weights may be experiencing growth and gaining investor confidence, while those with decreasing weights may be facing challenges.

- Investor Decision-Making: Understanding the weight of companies in the S&P 500 can help investors make informed decisions about their investment portfolios. By focusing on heavily weighted companies, investors can align their strategies with market trends.

- Sector Influence: The weight of companies also reflects the influence of different sectors in the market. Sectors with higher weights may have a more significant impact on the index's performance, indicating their importance in the economy.

Top S&P 500 Companies by Weight

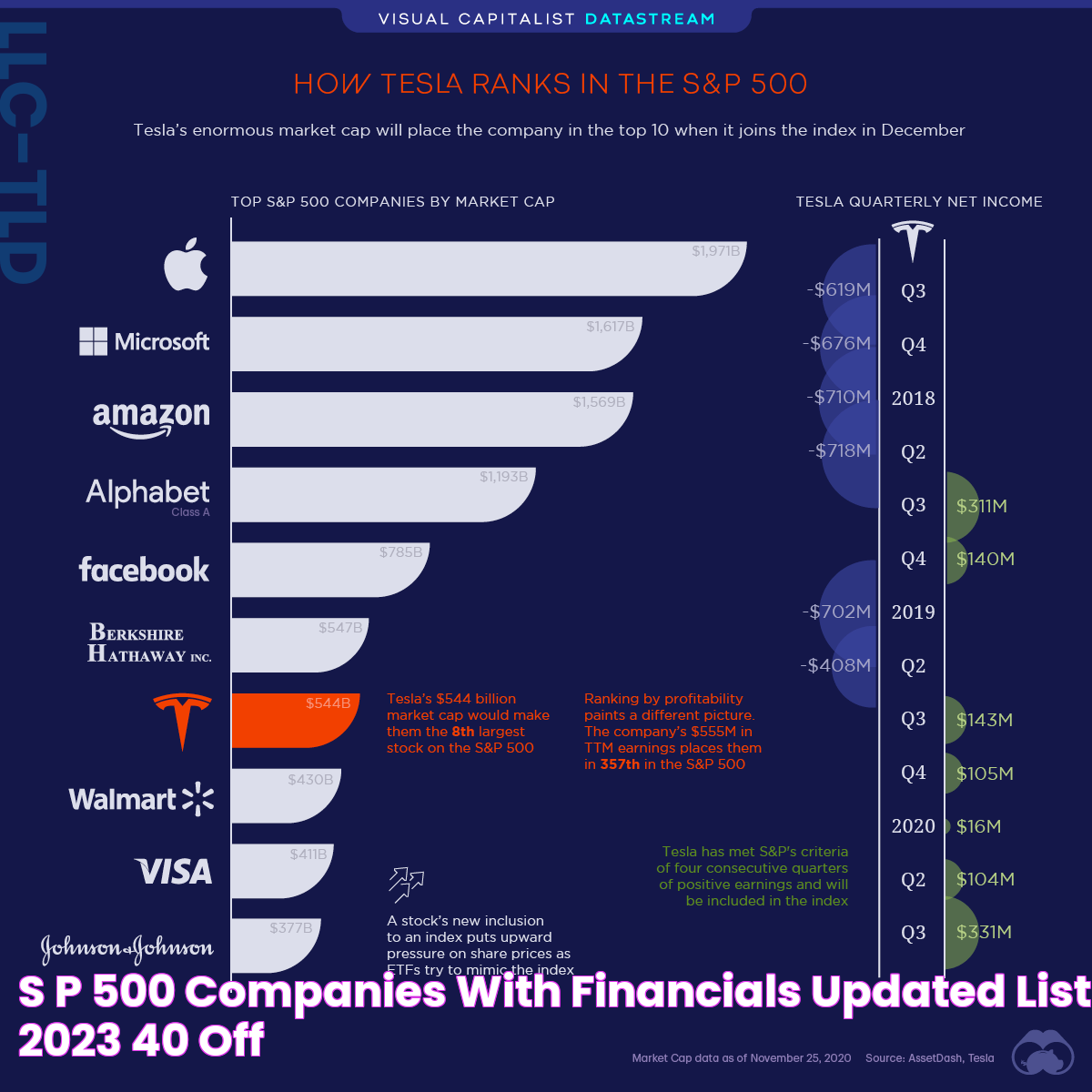

The following are some of the top S&P 500 companies by weight, known for their significant influence on the index:

Read also:Scott Hoying Age Biography And Insights Into His Life And Career

- Apple Inc.: As one of the largest companies in the world, Apple Inc. holds a substantial weight in the S&P 500. Its innovative products and strong market presence make it a key player in the technology sector.

- Microsoft Corporation: Another technology giant, Microsoft, has a significant influence on the index due to its software products and cloud services.

- Amazon.com Inc.: As a leading e-commerce and cloud computing company, Amazon holds a considerable weight in the S&P 500, reflecting its dominance in the retail and technology sectors.

- Alphabet Inc. (Google): The parent company of Google, Alphabet, has a strong presence in the index due to its leadership in internet services and digital advertising.

- Meta Platforms Inc. (Facebook): As a major player in social media, Meta Platforms has a substantial weight in the S&P 500, driven by its advertising revenue and user base.

Sector Distribution of S&P 500 Companies

The S&P 500 index includes companies from various sectors, each contributing differently to the index's performance. The sector distribution is as follows:

- Technology: This sector holds the largest weight in the index, with companies like Apple, Microsoft, and Alphabet leading the way.

- Healthcare: Companies like Johnson & Johnson and Pfizer are major players in this sector, contributing to the index's performance through their pharmaceutical and healthcare products.

- Consumer Discretionary: Amazon and Tesla are key companies in this sector, reflecting consumer spending and preferences.

- Financials: The financial sector includes banks and insurance companies like JPMorgan Chase and Berkshire Hathaway, impacting the index through their financial services.

- Communication Services: This sector includes major players like Meta Platforms and Netflix, influencing the index through their media and communication offerings.

How Do These Companies Impact the Stock Market?

The companies with the highest weight in the S&P 500 index have a significant impact on the stock market in several ways:

- Market Movements: Due to their large market capitalization, changes in the stock prices of these companies can cause significant movements in the overall market. A positive earnings report from a top-weighted company can boost investor confidence and drive the market higher.

- Economic Indicators: These companies are often seen as indicators of the economy's overall health. For example, strong performance from technology giants may suggest growth and innovation in the tech sector, influencing investor sentiment.

- Investment Strategies: Many investors and fund managers use the S&P 500 as a benchmark for their investment strategies. Changes in the weight of top companies can influence portfolio allocations and investment decisions.

- Sector Trends: The performance of heavily weighted companies can highlight trends within their respective sectors. For instance, a surge in the stock price of a major healthcare company may indicate advancements in medical technology or increased demand for healthcare services.

Apple Inc.: A Leader in Market Weight

Apple Inc. is one of the most influential companies in the S&P 500, with a significant market weight. Known for its innovative products, such as the iPhone, iPad, and Mac, Apple has a substantial impact on the technology sector and the broader market.

The company's success is driven by its strong brand reputation, loyal customer base, and continuous innovation. Apple's financial performance consistently exceeds expectations, contributing to its dominant position in the index. Its large market capitalization makes it a key player in the stock market, and changes in its stock price can influence market trends.

Apple's influence extends beyond its products, as it also plays a significant role in shaping technology trends. Its focus on sustainability and renewable energy initiatives has set industry standards, making it a leader in corporate responsibility. Investors closely monitor Apple's performance, as it is often seen as a bellwether for the technology sector.

Microsoft Corporation: Powerhouse in Technology

Microsoft Corporation is another major player in the S&P 500, with a substantial market weight. As a leading technology company, Microsoft is known for its software products, cloud services, and innovation in artificial intelligence.

The company's flagship products, such as Windows, Office, and Azure, have become essential tools for businesses and consumers worldwide. Microsoft's focus on cloud computing has driven significant growth, making it a leader in the technology sector.

Microsoft's financial performance is consistently strong, with steady revenue growth and a solid balance sheet. Its influence on the stock market is notable, as changes in its stock price can impact the overall market. Investors view Microsoft as a reliable investment, thanks to its diverse product portfolio and strategic acquisitions.

Amazon.com Inc.: Retail Giant's Influence

Amazon.com Inc. is a dominant force in the retail sector, with a significant weight in the S&P 500. Known for its e-commerce platform and cloud computing services, Amazon has revolutionized the way people shop and conduct business online.

The company's success is driven by its customer-centric approach, extensive product selection, and efficient supply chain. Amazon's Prime membership program offers fast shipping and exclusive content, attracting millions of loyal customers.

In addition to e-commerce, Amazon's Amazon Web Services (AWS) division has become a leader in cloud computing, providing services to businesses and governments worldwide. This diversification has contributed to Amazon's substantial market weight and influence on the stock market.

Alphabet Inc.: The Parent of Google

Alphabet Inc., the parent company of Google, is a significant player in the S&P 500, with a considerable market weight. Known for its dominance in internet search and digital advertising, Alphabet has a substantial impact on the technology sector.

Google's search engine is the most widely used worldwide, and its advertising platform generates significant revenue. Alphabet's focus on innovation has led to the development of products like Android, YouTube, and Google Cloud, further expanding its influence.

Alphabet's financial performance is strong, with consistent revenue growth driven by its advertising business and cloud services. Its influence on the stock market is notable, as changes in its stock price can affect market trends and investor sentiment.

Meta Platforms: Social Media Titan

Meta Platforms, formerly known as Facebook, is a major player in the S&P 500, with a substantial weight. As a leader in social media, Meta Platforms has a significant influence on the communication services sector.

The company's platforms, including Facebook, Instagram, and WhatsApp, boast billions of users worldwide, making it a dominant force in digital advertising. Meta's focus on virtual reality and the metaverse has positioned it as an innovator in the technology space.

Meta's financial performance is strong, with substantial revenue generated from its advertising business. Its influence on the stock market is evident, as changes in its stock price can impact market trends and investor sentiment.

What are the Benefits of Diversification in S&P 500?

Diversification is a key benefit of investing in the S&P 500, as it includes a wide range of companies from various sectors. This diversification offers several advantages:

- Risk Mitigation: By investing in a diversified index, investors can reduce the risk of significant losses. If one sector experiences a downturn, gains in other sectors can offset those losses.

- Exposure to Growth Opportunities: The S&P 500 includes companies from emerging industries, providing investors with exposure to growth opportunities and innovative technologies.

- Stable Returns: Diversification can lead to more stable returns over the long term, as the performance of one company or sector does not overly impact the overall index.

- Comprehensive Market Representation: The S&P 500 provides a comprehensive representation of the U.S. stock market, making it a reliable benchmark for investors.

Strategies for Investors: Focusing on Weighted Companies

Investors can develop strategies to focus on companies with higher weights in the S&P 500 to align their portfolios with market trends and opportunities:

- Focus on Leading Sectors: Identify sectors with the highest weights and invest in leading companies within those sectors to capitalize on growth opportunities.

- Monitor Market Trends: Stay informed about changes in the weight of top companies and adjust investment strategies accordingly to maximize returns.

- Diversify Within the Index: While focusing on weighted companies, maintain diversification within the index to mitigate risk and ensure balanced exposure.

- Utilize Index Funds: Consider investing in index funds or ETFs that track the S&P 500 to benefit from the performance of weighted companies.

Frequently Asked Questions

What is the significance of a company's weight in the S&P 500?

A company's weight in the S&P 500 reflects its influence on the index's performance. Companies with higher weights have a more significant impact on the index and can indicate market trends and investor sentiment.

How often is the S&P 500 rebalanced?

The S&P 500 is rebalanced quarterly to ensure it accurately reflects current market conditions. This involves adjusting the weights of companies based on changes in their market capitalization.

What are the top sectors in the S&P 500 by weight?

The technology sector holds the largest weight in the S&P 500, followed by healthcare, consumer discretionary, financials, and communication services.

How do changes in the weight of a company affect investors?

Changes in a company's weight can impact investor strategies and portfolio allocations. Investors may adjust their holdings based on the performance and influence of heavily weighted companies.

Can individual investors track the S&P 500 index directly?

Yes, individual investors can track the S&P 500 index through index funds or exchange-traded funds (ETFs) that replicate its performance.

What role do dividends play in the S&P 500?

Dividends contribute to the total return of the S&P 500. Companies in the index may pay dividends, providing income to investors in addition to capital appreciation.

Conclusion

The S&P 500 index is a crucial tool for investors and analysts, providing insights into the performance of the largest publicly traded companies in the United States. Understanding the weight of companies within the index is essential for making informed investment decisions and gauging market trends. By focusing on the top S&P 500 companies by weight, investors can align their strategies with market movements and capitalize on growth opportunities. Diversification within the index offers risk mitigation and exposure to various sectors, making the S&P 500 a reliable benchmark for portfolio management.

For more information on the S&P 500 index and its impact on the stock market, visit SlickCharts, a comprehensive resource for S&P 500 data and analysis.