In the world of finance and investment, the term "ponzi scam" has been synonymous with deceit and fraud for over a century. Named after Charles Ponzi, who orchestrated one of the most infamous scams in the early 20th century, this financial scheme continues to thrive in various forms, targeting unsuspecting investors with the promise of high returns. The allure of quick and easy money can be tempting, but understanding the mechanics of a ponzi scam is crucial in safeguarding oneself from falling victim to such fraudulent activities.

At its core, a ponzi scam relies on the perpetrator collecting funds from new investors to pay returns to earlier investors, creating the illusion of a profitable venture. However, there is typically no legitimate business operation generating these returns; instead, the scammer uses the capital from new participants to maintain the facade of success. As the scam expands, the need for new investors grows, ultimately leading to the scheme's collapse when it becomes unsustainable. This leaves many investors with significant financial losses, while the orchestrator often vanishes with a substantial amount of illicitly acquired money.

Despite increased regulatory scrutiny and public awareness, ponzi scams continue to evolve and adapt, exploiting new opportunities in various sectors, including cryptocurrency and online investments. This article aims to equip readers with the knowledge and tools to identify, avoid, and report ponzi scams, thereby empowering individuals to make informed financial decisions. Through a comprehensive examination of its history, characteristics, and modern manifestations, we hope to demystify the ponzi scam and contribute to a more secure and transparent financial environment.

Read also:Mustang Gt Horsepower A Powerhouse Of Performance

Table of Contents

- History of the Ponzi Scam

- How Does a Ponzi Scam Work?

- Characteristics of a Ponzi Scam

- Famous Ponzi Scam Cases

- Modern Ponzi Scams in Cryptocurrency

- How to Identify a Ponzi Scam?

- Prevention Strategies

- Legal Repercussions of Ponzi Scams

- Impact of Ponzi Scams on Investors

- Role of Regulatory Bodies

- How to Report a Ponzi Scam?

- Real-Life Experiences

- How to Recover from a Ponzi Scam?

- Educational Resources on Financial Fraud

- FAQs

- Conclusion

History of the Ponzi Scam

The origins of the ponzi scam can be traced back to the early 20th century, with Charles Ponzi's infamous scheme in 1919 serving as the archetype. Ponzi promised investors a 50% return within 45 days, leveraging a supposed arbitrage opportunity involving international reply coupons. His operation quickly gained traction, attracting thousands of investors and millions of dollars. However, the scheme's flawed foundation eventually led to its inevitable collapse, leaving many financially devastated.

Despite its notorious beginnings, the ponzi scam has persisted and evolved over the years. Variations of this fraudulent scheme have appeared across different industries, adapting to new technologies and economic landscapes. The enduring appeal of quick, high returns continues to captivate investors, perpetuating the cycle of deceit. Understanding the history of the ponzi scam is essential for recognizing its recurring patterns and preventing future occurrences.

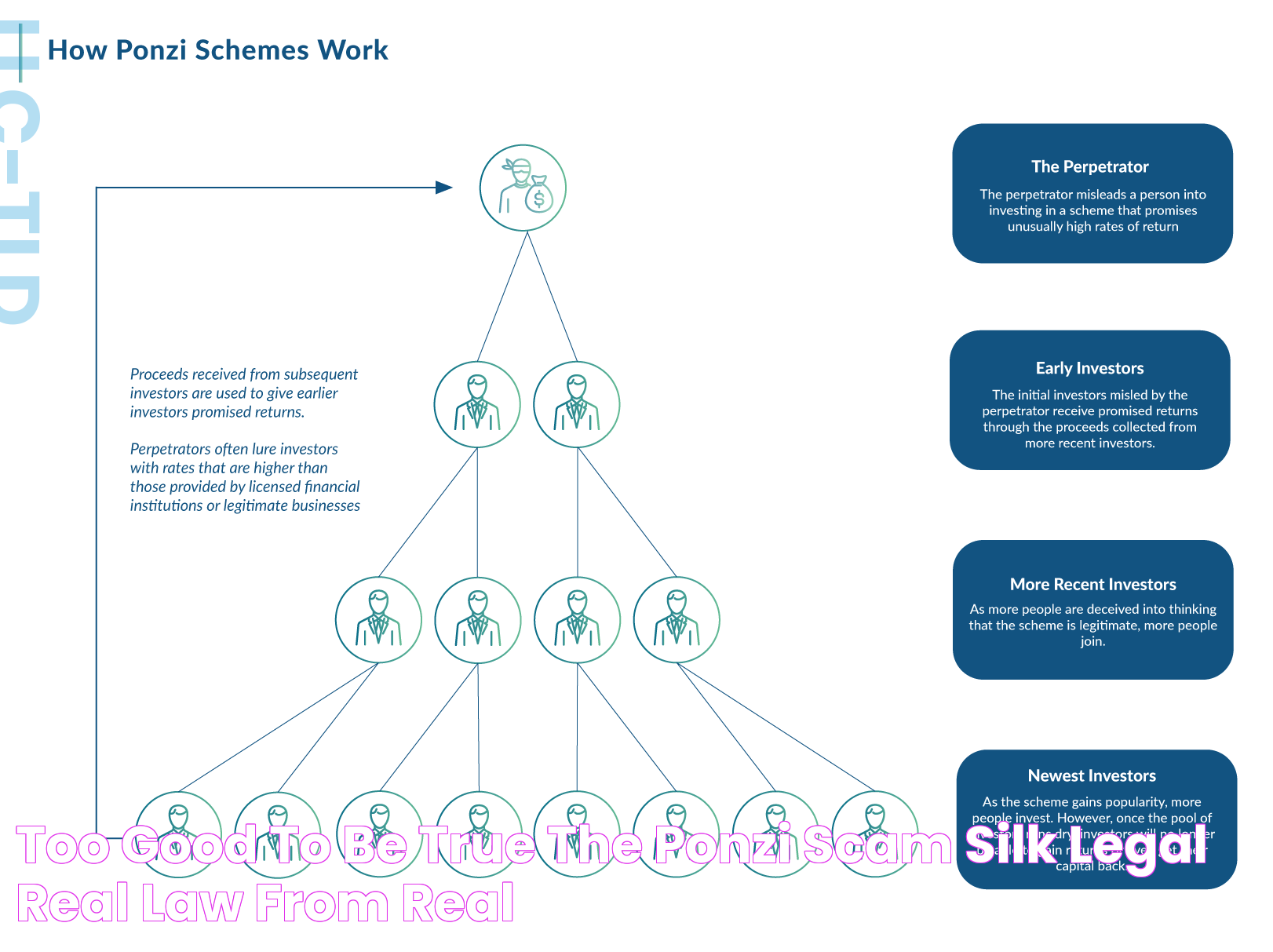

How Does a Ponzi Scam Work?

A ponzi scam operates by creating a financial illusion, enticing investors with promises of high, consistent returns. The scammer collects funds from new investors and uses that money to pay returns to earlier investors, giving the appearance of a successful and profitable venture. However, there is no legitimate business generating profits; the scheme relies entirely on the influx of new participants to sustain itself.

As the ponzi scam expands, it becomes increasingly difficult to recruit enough new investors to cover the promised returns. Eventually, the scheme collapses under its own weight, leaving many participants with significant financial losses. The orchestrator often disappears with the remaining funds, leaving investors with little recourse for recovery.

Characteristics of a Ponzi Scam

Recognizing the common characteristics of a ponzi scam can help potential investors avoid falling victim to such fraudulent schemes. Some key indicators include:

- Promises of high, consistent returns with little or no risk

- Overly complex or vague explanations of how profits are generated

- Lack of transparency or audited financial statements

- Pressure to reinvest returns or recruit new participants

- Difficulty withdrawing funds or receiving returns

By staying vigilant and questioning unusually high returns or complex investment structures, investors can better protect themselves from the dangers of a ponzi scam.

Read also:Enhancing Meals With Medium Eggs Nutritional Benefits And Culinary Uses

Famous Ponzi Scam Cases

Throughout history, numerous high-profile ponzi scams have captured public attention and underscored the devastating impact of financial fraud. Some of the most notorious cases include:

- Bernie Madoff: Perhaps the most infamous modern ponzi scam, Madoff's scheme defrauded thousands of investors of billions of dollars over several decades before collapsing in 2008.

- Allen Stanford: Stanford's ponzi scam involved the sale of fraudulent certificates of deposit, bilking investors out of an estimated $7 billion before his arrest in 2009.

- Tom Petters: Petters orchestrated a $3.65 billion ponzi scam that collapsed in 2008, resulting in a 50-year prison sentence for the perpetrator.

These cases highlight the far-reaching consequences of ponzi scams and the importance of remaining vigilant against financial fraud.

Modern Ponzi Scams in Cryptocurrency

With the rise of digital currencies and blockchain technology, ponzi scams have found a new frontier in the cryptocurrency market. Scammers exploit the decentralized nature and relative anonymity of cryptocurrencies to perpetrate their schemes, often targeting individuals with limited knowledge of the technology. Some common tactics include:

- Ponzi schemes disguised as legitimate cryptocurrency investment platforms

- Fake initial coin offerings (ICOs) promising high returns

- Pyramid schemes leveraging cryptocurrencies to recruit new participants

By staying informed about the latest developments in the cryptocurrency space and conducting thorough due diligence, investors can better protect themselves from these modern ponzi scams.

How to Identify a Ponzi Scam?

Identifying a ponzi scam requires a keen eye for suspicious activity and an understanding of common red flags. Some key steps to identifying a ponzi scam include:

- Researching the investment opportunity, including the company's history and leadership

- Verifying the legitimacy of returns and the underlying business model

- Seeking independent financial advice from reputable sources

- Being wary of pressure tactics or promises of high returns with little risk

- Checking for regulatory registration and compliance

By remaining cautious and conducting thorough research, investors can minimize their risk of falling victim to a ponzi scam.

Prevention Strategies

Preventing ponzi scams requires a proactive approach from both investors and regulatory bodies. Some effective strategies include:

- Enhancing public awareness and education on financial fraud

- Implementing stricter regulatory oversight and enforcement

- Encouraging transparency and accountability in investment practices

- Promoting the use of secure, verifiable financial technologies

By working together, investors and regulators can create a more secure financial environment and reduce the prevalence of ponzi scams.

Legal Repercussions of Ponzi Scams

Ponzi scams are illegal and carry severe legal consequences for those involved. Perpetrators may face criminal charges, including fraud, conspiracy, and money laundering, resulting in significant fines and lengthy prison sentences. Additionally, victims of ponzi scams may pursue civil litigation to recover lost funds, though recovery is often challenging and incomplete.

Understanding the legal repercussions of ponzi scams serves as a deterrent for potential perpetrators and underscores the importance of adhering to ethical investment practices.

Impact of Ponzi Scams on Investors

Ponzi scams can have devastating financial and emotional impacts on investors. Victims may suffer significant financial losses, eroding their savings and leaving them in debt. The emotional toll of being deceived can also be profound, leading to feelings of shame, anger, and mistrust in financial institutions.

Recognizing the impact of ponzi scams on investors highlights the importance of education and vigilance in preventing financial fraud.

Role of Regulatory Bodies

Regulatory bodies play a crucial role in preventing and addressing ponzi scams. Agencies such as the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA) are responsible for enforcing securities laws and protecting investors. Key functions of regulatory bodies include:

- Conducting investigations and audits of investment firms

- Issuing warnings and alerts about fraudulent schemes

- Implementing and enforcing regulations to ensure transparency and compliance

By maintaining a strong regulatory framework, these agencies help safeguard investors and promote a trustworthy financial environment.

How to Report a Ponzi Scam?

Reporting a ponzi scam is a critical step in preventing further harm and holding perpetrators accountable. Individuals who suspect a ponzi scam should take the following steps:

- Gather evidence, including documentation of communications and transactions

- Contact relevant regulatory bodies, such as the SEC or local financial authorities

- File a complaint with consumer protection agencies

- Consult with legal professionals for guidance on potential civil litigation

By reporting ponzi scams, victims can contribute to broader efforts to combat financial fraud and protect other investors.

Real-Life Experiences

Hearing from individuals who have experienced ponzi scams firsthand can provide valuable insights and lessons for others. Many victims share their stories to raise awareness and help others avoid falling into similar traps. These real-life accounts highlight the importance of vigilance, skepticism, and thorough research in investment decisions.

Through shared experiences, the financial community can learn and grow together, fostering a more informed and resilient investment landscape.

How to Recover from a Ponzi Scam?

Recovering from a ponzi scam can be a challenging and lengthy process. Victims should focus on rebuilding their financial security and emotional well-being. Key steps to recovery include:

- Seeking financial counseling and assistance to assess and address financial losses

- Engaging in legal action to recover lost funds, if possible

- Rebuilding trust in financial institutions through education and due diligence

- Joining support groups or seeking therapy to address emotional impacts

By taking proactive steps, victims can regain control of their financial future and move forward from the experience.

Educational Resources on Financial Fraud

Education is a powerful tool in preventing ponzi scams and other forms of financial fraud. Numerous resources are available to help individuals understand and navigate the complexities of the financial world, including:

- Online courses and webinars on investment and financial literacy

- Guides and articles from reputable financial institutions and organizations

- Workshops and seminars offered by regulatory bodies and consumer protection agencies

By leveraging these resources, individuals can arm themselves with the knowledge needed to make informed investment decisions and protect against financial fraud.

FAQs

- What is a ponzi scam? A ponzi scam is a fraudulent investment scheme where returns are paid to earlier investors using the capital from new investors, rather than from legitimate business profits.

- How can I protect myself from a ponzi scam? Stay informed about investment opportunities, conduct thorough research, and seek advice from reputable financial professionals.

- What should I do if I suspect a ponzi scam? Gather evidence, report the scam to regulatory bodies, and consult with legal professionals for guidance.

- Are ponzi scams illegal? Yes, ponzi scams are illegal and carry severe legal consequences for those involved.

- Can I recover my money if I've been a victim of a ponzi scam? Recovery can be challenging, but victims may pursue legal action and seek financial counseling to address losses.

- How do regulatory bodies help prevent ponzi scams? Regulatory bodies enforce securities laws, conduct investigations, and promote transparency to protect investors from fraudulent schemes.

Conclusion

The persistence of ponzi scams underscores the importance of vigilance, education, and regulation in the financial world. By understanding the characteristics and workings of these fraudulent schemes, individuals can better protect themselves and contribute to a safer investment environment. Through collaboration between investors, regulatory bodies, and educational resources, we can work towards eradicating ponzi scams and fostering a more transparent, trustworthy financial landscape.

For more information and resources on financial fraud, visit the SEC's Investor Alerts and Bulletins page.