Planning for retirement is a crucial aspect of financial stability, and New York State offers a comprehensive retirement system to support its residents. With a range of benefits and programs, individuals can secure their future and ensure a comfortable post-retirement life. Understanding the intricacies of the New York State retirement system is essential for making informed decisions and maximizing benefits.

New York State's retirement system is designed to provide financial security to public employees, offering various plans tailored to different professions and needs. From pension plans to health benefits, retirees have access to a host of resources to support their lifestyle after leaving the workforce. This system not only supports public employees but also contributes to the state's economy by ensuring a stable standard of living for its retirees.

As you embark on your retirement planning journey, understanding the eligibility criteria, benefit calculations, and available resources is vital. In this guide, we'll explore the key elements of the New York State retirement system, providing insights into how you can effectively plan for retirement and make the most of the available benefits. With careful planning and informed decisions, you can secure a financially stable and fulfilling retirement.

Read also:Paying Tribute Honoring Amy Roloffs Legacy Through Her Funeral

Table of Contents

- Overview of New York State Retirement System

- Who is Eligible for New York State Retirement?

- Types of Retirement Plans in New York State

- Understanding Pension Benefits

- What is Vesting and How Does it Work?

- Calculating Your Retirement Benefits

- Health Benefits for Retirees

- Early Retirement Options and Considerations

- Financial Planning for Retirement

- Resources and Tools for Retirement Planning

- Common Challenges in Retirement Planning

- Frequently Asked Questions

- Conclusion

Overview of New York State Retirement System

The New York State Retirement System is a robust network designed to provide financial security to public employees after they retire. It encompasses several plans that cater to different employment sectors, including teachers, police officers, and firefighters. This system is managed by the New York State and Local Retirement System (NYSLRS), which oversees the distribution of benefits and ensures compliance with state regulations.

NYSLRS comprises two primary components: the Employees' Retirement System (ERS) and the Police and Fire Retirement System (PFRS). Both systems offer defined benefit plans, meaning that retirement benefits are calculated based on a formula involving years of service and final average salary. This structure provides a predictable income stream, offering retirees peace of mind regarding their financial future.

Moreover, the New York State Retirement System is funded through employee contributions, employer contributions, and investment earnings. The system's assets are prudently managed to ensure long-term sustainability and the ability to meet future obligations. This comprehensive approach ensures that the retirement system remains a reliable source of income for its beneficiaries.

Who is Eligible for New York State Retirement?

Eligibility for the New York State Retirement System is primarily determined by employment status and membership in one of the retirement plans. Public employees working for state and local governments, as well as certain educational institutions, are typically eligible for membership in the Employees' Retirement System (ERS) or the Police and Fire Retirement System (PFRS).

To qualify for retirement benefits, employees must meet specific criteria related to age and years of service. Generally, employees become eligible for a full pension upon reaching a certain age and completing a minimum number of service years. However, the specific requirements vary depending on the retirement tier to which the employee belongs.

In addition to age and service requirements, employees must also contribute to the retirement system throughout their employment. Contributions are deducted from employees' salaries and vary based on the plan and tier. These contributions help fund the retirement benefits and ensure the system's sustainability.

Read also:Mastering T9 To Text The Future Of Mobile Communication

Types of Retirement Plans in New York State

New York State offers several retirement plans, each tailored to the unique needs of different employment groups. The two main plans are the Employees' Retirement System (ERS) and the Police and Fire Retirement System (PFRS). Within these systems, there are multiple tiers, each with distinct rules and benefits.

Employees' Retirement System (ERS)

The ERS is designed for non-uniformed public employees, including state and local government workers, educators, and certain university staff. It provides a defined benefit plan, offering a lifetime pension based on the employee's service and salary history. ERS members are divided into several tiers, with Tier 1 being the oldest and Tier 6 the newest.

Police and Fire Retirement System (PFRS)

The PFRS specifically caters to uniformed personnel, such as police officers and firefighters. Like the ERS, it offers a defined benefit plan, ensuring a secure income stream for retirees. The PFRS also features multiple tiers, each with its own set of eligibility criteria and benefit calculations.

Understanding Pension Benefits

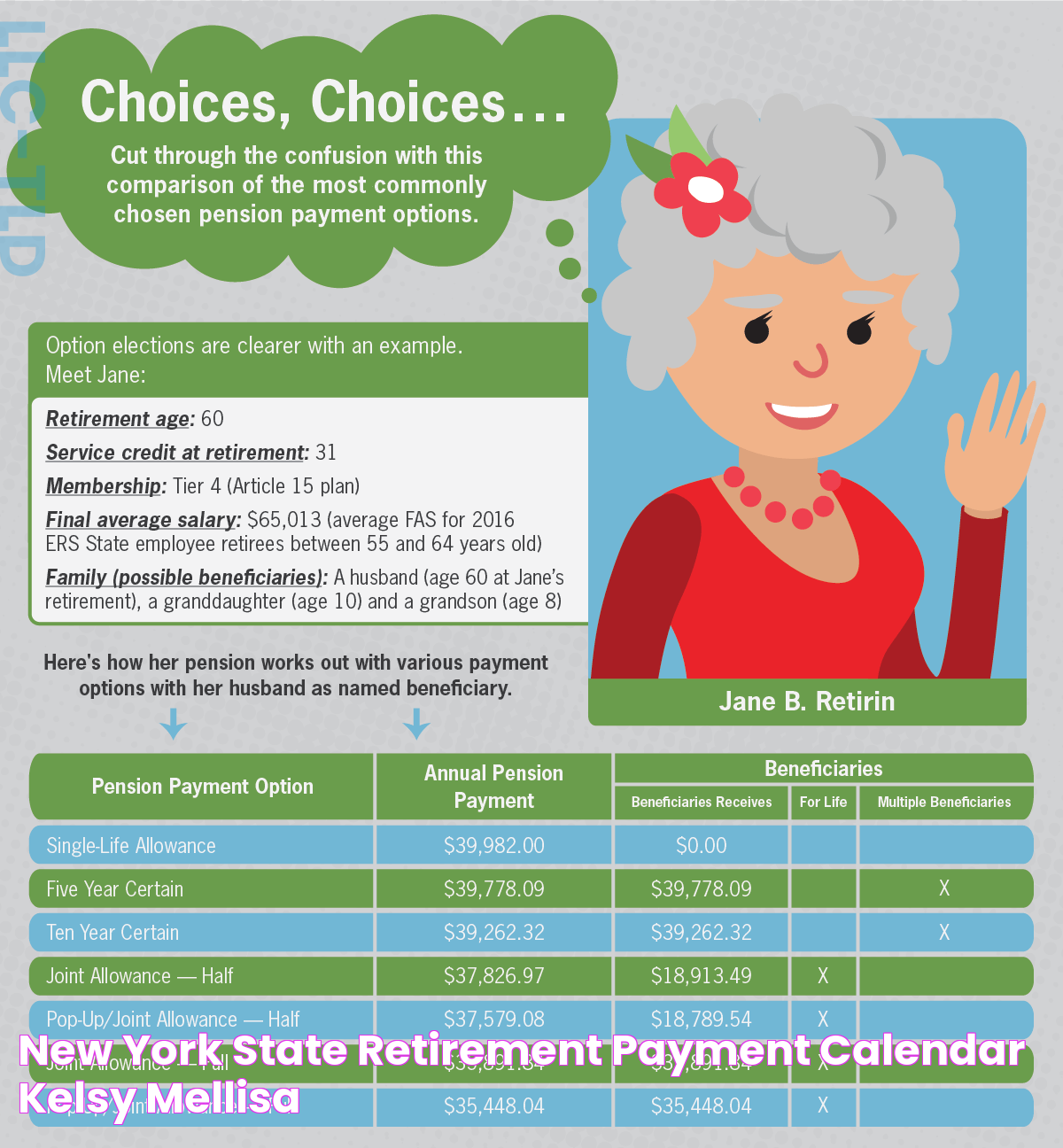

Pension benefits are a cornerstone of the New York State Retirement System, providing a reliable source of income for retirees. These benefits are calculated using a formula based on the retiree's years of service and final average salary. The final average salary is typically the average of the highest consecutive three years of salary.

Pension benefits offer significant advantages, including:

- Predictable income stream

- Lifetime payments

- Cost-of-living adjustments (COLA)

Retirees can choose from various payment options, including single-life annuities and joint-and-survivor annuities. Each option has its own implications for the amount of benefit received and the duration of payments.

What is Vesting and How Does it Work?

Vesting is a critical concept in retirement planning, referring to the employee's right to receive benefits from the retirement system. Once an employee is vested, they are entitled to receive a pension upon retirement, even if they leave public employment before reaching retirement age.

The vesting period varies depending on the retirement plan and tier. For most ERS and PFRS members, vesting occurs after five to ten years of service. Once vested, employees can retire with a reduced benefit or wait until they reach full retirement age to receive the maximum benefit.

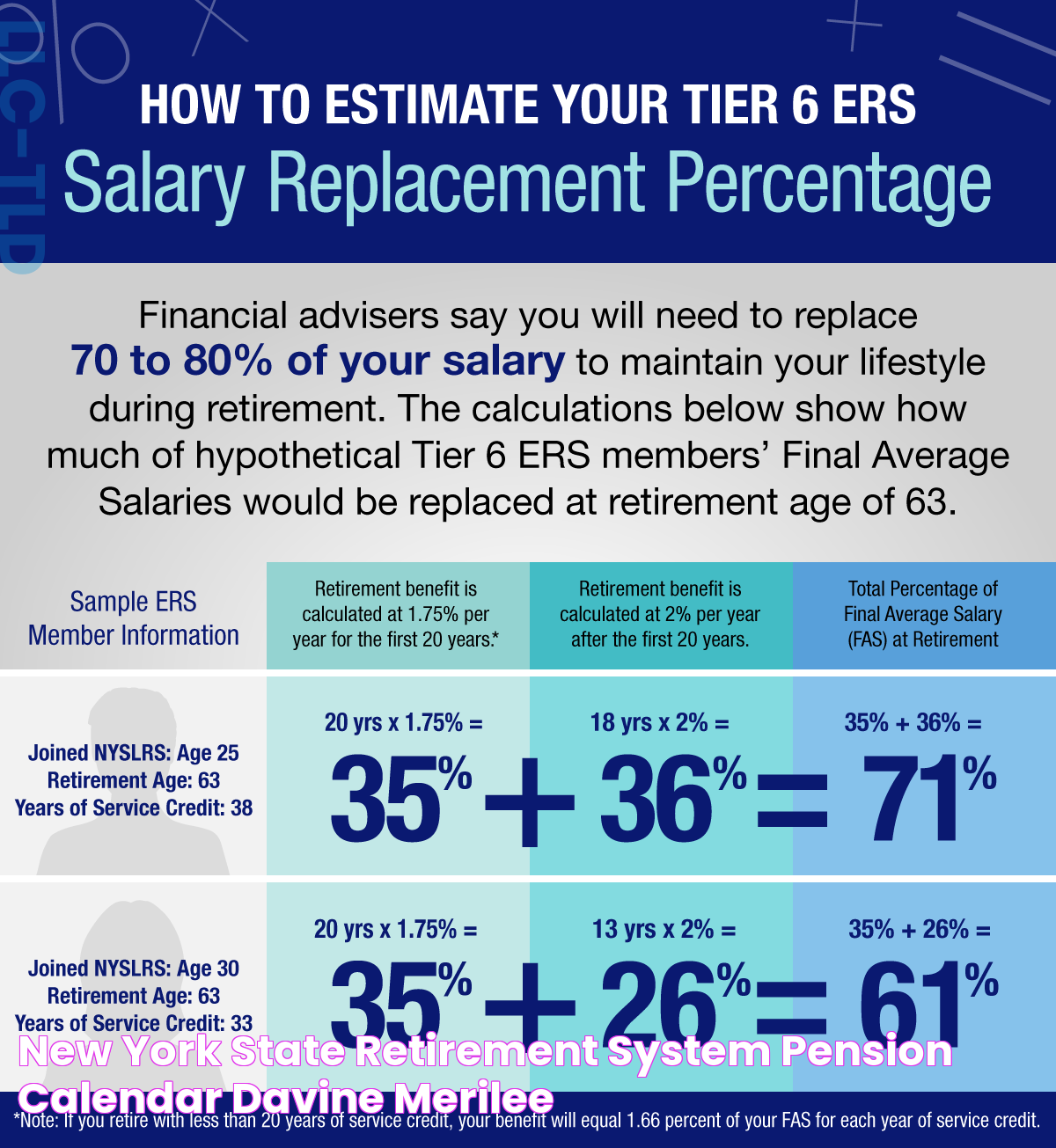

Calculating Your Retirement Benefits

Calculating retirement benefits involves considering several factors, including years of service, final average salary, and the chosen payment option. The basic formula for calculating a pension is:

Pension Benefit = (Years of Service) x (Benefit Factor) x (Final Average Salary)

The benefit factor is a percentage determined by the employee's retirement tier and age at retirement. The final average salary is calculated based on the highest consecutive three years of salary, ensuring that the pension reflects the employee's peak earning period.

Employees can estimate their retirement benefits using online calculators provided by the New York State Retirement System. These tools provide a personalized estimate based on the employee's unique circumstances and retirement goals.

Health Benefits for Retirees

Retirees in the New York State Retirement System have access to comprehensive health benefits, ensuring continued healthcare coverage after leaving the workforce. These benefits typically include medical, dental, and vision coverage, providing essential support for retirees' health and well-being.

The specific health benefits available depend on the retiree's employment history and the terms of their retirement plan. Some retirees may be eligible for additional benefits, such as long-term care insurance or prescription drug coverage.

Early Retirement Options and Considerations

Early retirement is an attractive option for many individuals, offering the opportunity to leave the workforce before reaching full retirement age. However, it requires careful consideration and planning to ensure financial stability throughout retirement.

Employees considering early retirement should evaluate the impact on their pension benefits, as retiring early often results in reduced payments. Additionally, they should assess their healthcare needs and ensure they have adequate coverage until they become eligible for Medicare.

Financial Planning for Retirement

Effective financial planning is essential for a secure and fulfilling retirement. It involves assessing current finances, setting goals, and developing a comprehensive plan to achieve those goals. Key components of financial planning include:

- Budgeting for retirement expenses

- Investing in retirement accounts

- Managing debt

- Maximizing Social Security benefits

Financial planners and advisors can provide valuable guidance and support, helping individuals navigate the complexities of retirement planning and make informed decisions.

Resources and Tools for Retirement Planning

New York State offers a wealth of resources and tools to assist individuals in planning for retirement. These resources include online calculators, informational seminars, and personalized counseling services.

Online calculators allow individuals to estimate their retirement benefits and assess different scenarios, providing valuable insights into potential outcomes. Informational seminars and workshops offer opportunities to learn about retirement planning strategies and connect with experts in the field.

Common Challenges in Retirement Planning

While retirement planning offers numerous benefits, it also presents several challenges that individuals must navigate. Common challenges include:

- Rising healthcare costs

- Inflation and its impact on purchasing power

- Longevity risk, or the risk of outliving retirement savings

- Market volatility and its effect on investment returns

Addressing these challenges requires proactive planning, diversification of income sources, and a focus on long-term financial security.

Frequently Asked Questions

What is the New York State Retirement System?

The New York State Retirement System is a network that provides retirement benefits to public employees, including pension plans and health benefits.

How do I become eligible for New York State retirement benefits?

Eligibility is based on employment status, membership in a retirement plan, and meeting specific age and service requirements.

What are the main types of retirement plans in New York State?

The main plans are the Employees' Retirement System (ERS) and the Police and Fire Retirement System (PFRS), each with multiple tiers.

How is my pension benefit calculated?

Pension benefits are calculated using a formula based on years of service, benefit factor, and final average salary.

What health benefits are available to retirees?

Retirees have access to comprehensive health benefits, including medical, dental, and vision coverage.

What should I consider when planning for early retirement?

Consider the impact on pension benefits, healthcare coverage, and overall financial stability.

Conclusion

Planning for retirement in New York State involves understanding the various components of the retirement system, from eligibility and benefit calculations to health coverage and financial planning. By leveraging available resources and making informed decisions, individuals can ensure a secure and fulfilling retirement. The New York State Retirement System provides a strong foundation for retirees, offering peace of mind and financial stability for the future.