Jim Simons, often celebrated as one of the most successful hedge fund managers in history, has built a net worth that leaves many in awe. Known for his extraordinary mathematical prowess and innovative approach to finance, Simons has become a towering figure in the investment world. His net worth reflects not only his financial acumen but also the groundbreaking strategies that have consistently outperformed traditional market benchmarks. As the founder of Renaissance Technologies, a highly successful quantitative investment firm, Simons has revolutionized the way money is managed, leveraging algorithms and data to gain an edge over the competition.

Simons' journey to wealth is anything but conventional. Before entering the world of finance, he made a name for himself in academia as a prominent mathematician. His transition from theoretical mathematics to hedge fund management is a testament to his ability to apply scientific principles to real-world challenges. Despite retiring from Renaissance Technologies in 2009, Simons' influence and legacy continue to shape the firm and the broader financial landscape. His wealth is not just a testament to his success in finance but also a reflection of his contributions to mathematics and philanthropy.

The net worth of Jim Simons is a subject of fascination for many, not only because of the sheer amount but also due to the manner in which it was amassed. His story inspires curiosity about the strategies employed by Renaissance Technologies, the impact of his philanthropic efforts, and the personal qualities that have propelled him to such heights. In this article, we delve into the life and career of Jim Simons, exploring the factors that have culminated in his remarkable net worth and the legacy he continues to build.

Read also:Mastering The Future A Deep Dive Into The Lithium Refining Business

Table of Contents

- Biography of Jim Simons

- What Were Jim Simons' Early Life and Education?

- Jim Simons' Academic Achievements

- How Did Jim Simons Transition to Finance?

- The Founding of Renaissance Technologies

- Investment Strategies of Renaissance Technologies

- Jim Simons Net Worth Overview

- Philanthropic Efforts of Jim Simons

- Jim Simons' Personal Life and Interests

- Awards and Recognition

- Jim Simons' Influence on Finance

- What is Jim Simons' Legacy?

- Frequently Asked Questions

- Conclusion

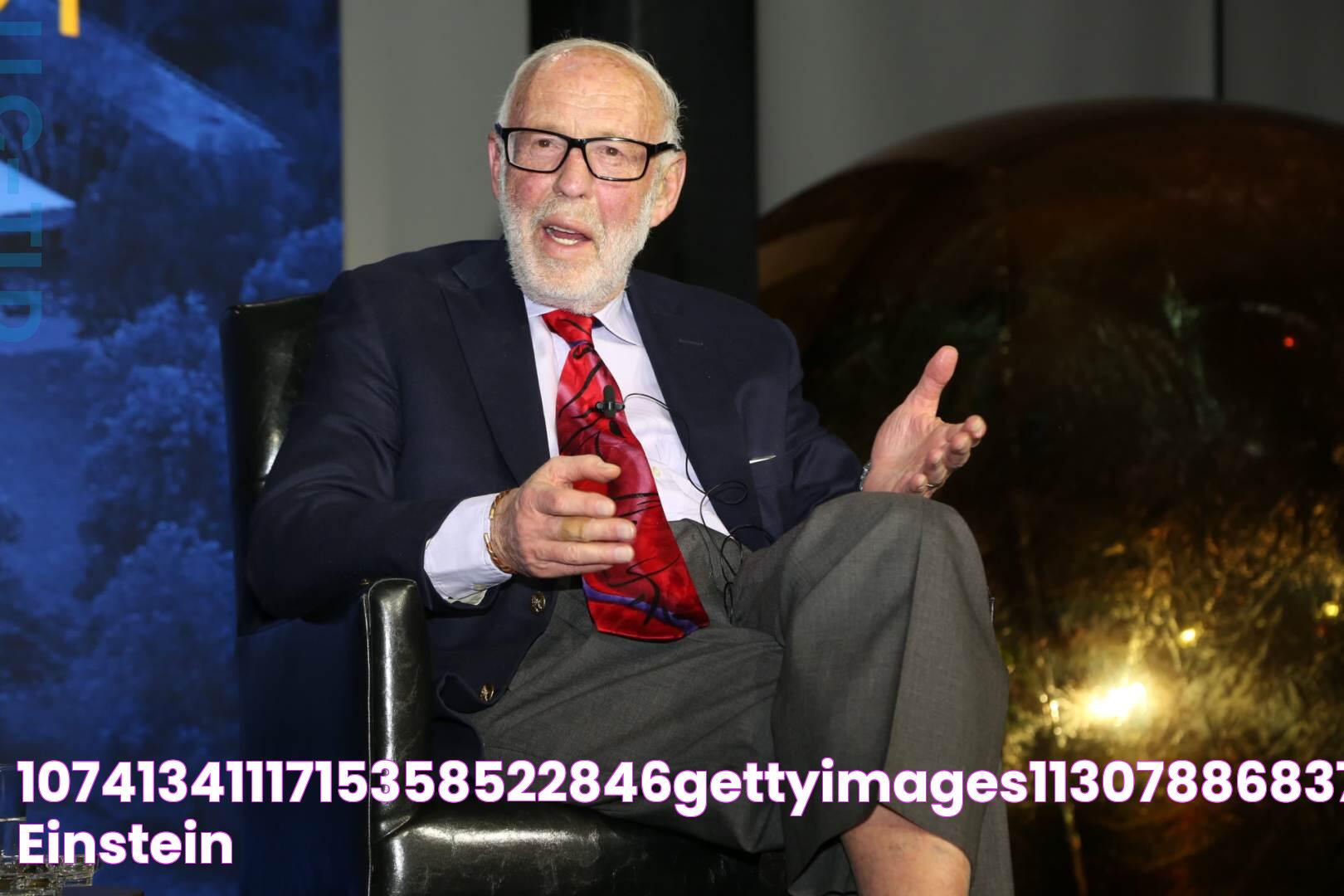

Biography of Jim Simons

James Harris Simons, known as Jim Simons, was born on April 25, 1938, in Newton, Massachusetts. He is an American mathematician, hedge fund manager, and philanthropist. Simons is renowned for his work in mathematics and his success in the financial world. He is the founder of Renaissance Technologies, a private hedge fund based in Setauket-East Setauket, New York.

Simons' early interest in mathematics led him to pursue a Bachelor of Science degree in mathematics from the Massachusetts Institute of Technology (MIT) in 1958. He obtained his Ph.D. in mathematics from the University of California, Berkeley, in 1961, under the supervision of Bertram Kostant.

| Full Name | James Harris Simons |

|---|---|

| Date of Birth | April 25, 1938 |

| Place of Birth | Newton, Massachusetts, USA |

| Education | MIT (B.Sc.), UC Berkeley (Ph.D.) |

| Occupation | Mathematician, Hedge Fund Manager, Philanthropist |

| Notable Work | Founder of Renaissance Technologies |

What Were Jim Simons' Early Life and Education?

Jim Simons grew up in a Jewish family in Brookline, Massachusetts. His father owned a shoe factory, and his mother was a homemaker. From a young age, Simons exhibited a natural aptitude for mathematics, which was encouraged by his parents. He attended Newton High School, where he excelled academically.

In 1958, Simons graduated from MIT with a Bachelor of Science degree in mathematics. His time at MIT was pivotal, as it exposed him to advanced mathematical theories and connected him with influential mentors. After MIT, he pursued a Ph.D. in mathematics at UC Berkeley, where he specialized in differential geometry, a field that would later inform his work in finance.

Jim Simons' Academic Achievements

Simons' academic career was marked by significant contributions to mathematics. After completing his Ph.D., he joined the Institute for Defense Analyses (IDA), a research center affiliated with Princeton University. His work at IDA focused on cryptography during the Vietnam War, though he eventually resigned due to his opposition to the war.

In 1968, Simons became a faculty member at Stony Brook University, where he served as the chair of the mathematics department. During his tenure, he made groundbreaking contributions to the field of differential geometry, particularly in collaboration with Shiing-Shen Chern. Their work led to the development of the Chern-Simons theory, which has had profound implications in both mathematics and theoretical physics.

Read also:Uncover The Wonders Of Skyes Avi A Detailed Exploration

How Did Jim Simons Transition to Finance?

Jim Simons' transition from academia to finance was driven by his fascination with applying mathematical models to solve complex problems. In 1978, he left his academic position to found Monemetrics, a quantitative investment firm. This move marked the beginning of his illustrious career in finance.

Monemetrics eventually evolved into Renaissance Technologies in 1982. Simons' approach to investing was revolutionary, as it relied heavily on mathematical models and statistical analyses to predict market trends. This quantitative approach set Renaissance Technologies apart from traditional investment firms and laid the foundation for its future success.

The Founding of Renaissance Technologies

Renaissance Technologies was founded by Jim Simons in 1982, and it quickly became a pioneer in the use of quantitative analysis for investment. The firm's flagship fund, the Medallion Fund, is renowned for its exceptional returns, largely due to its reliance on sophisticated mathematical models and algorithms.

Under Simons' leadership, Renaissance Technologies attracted some of the brightest minds from fields such as mathematics, physics, and computer science. The firm's unique culture fostered innovation and collaboration, resulting in groundbreaking strategies that consistently outperformed the market.

Investment Strategies of Renaissance Technologies

Renaissance Technologies' success is largely attributed to its proprietary trading algorithms and data-driven approach. The firm employs a range of quantitative strategies, including statistical arbitrage, pattern recognition, and machine learning, to identify and capitalize on market inefficiencies.

Key elements of Renaissance's investment strategy include:

- Data-Driven Decision Making: The firm collects and analyzes vast amounts of data to inform its trading decisions.

- Short-Term Trading: Renaissance often engages in short-term trades to exploit temporary market inefficiencies.

- Diversification: The firm's portfolios are highly diversified across asset classes and geographies.

- Risk Management: Advanced risk management techniques are employed to minimize losses and optimize returns.

Jim Simons Net Worth Overview

Jim Simons' net worth has been a subject of intrigue and admiration, reflecting his unparalleled success in the world of finance. As of 2023, his estimated net worth stands at approximately $23 billion, making him one of the wealthiest individuals in the United States.

Several factors contribute to Simons' substantial wealth:

- Renaissance Technologies' Consistent Performance: The Medallion Fund, in particular, has delivered annualized returns of over 30% since its inception.

- Diversified Investments: Simons has strategically diversified his investments, further bolstering his wealth.

- Philanthropic Contributions: Despite his immense wealth, Simons is also known for his generous philanthropic efforts, which have earned him widespread respect and admiration.

Philanthropic Efforts of Jim Simons

Jim Simons is not only known for his financial acumen but also for his commitment to philanthropy. Through the Simons Foundation, which he co-founded with his wife, Marilyn Simons, he has contributed billions of dollars to various causes, particularly in the fields of education, health, and scientific research.

Notable philanthropic initiatives include:

- The Simons Foundation Autism Research Initiative (SFARI): A program dedicated to advancing the understanding and treatment of autism spectrum disorders.

- Math for America: An organization that supports and promotes excellence in mathematics education in the United States.

- Stony Brook University: Simons has been a significant benefactor of his former academic institution, funding scholarships, research programs, and facility improvements.

Jim Simons' Personal Life and Interests

Despite his high-profile career, Jim Simons maintains a relatively private personal life. He resides in Long Island, New York, with his wife, Marilyn Simons. The couple has supported numerous philanthropic initiatives together, further cementing their legacy as generous benefactors.

In addition to his philanthropic endeavors, Simons is known for his passion for sailing and music. He is an accomplished sailor and has participated in numerous yacht races. Music also holds a special place in his life, and he is an avid supporter of the arts.

Awards and Recognition

Jim Simons' contributions to mathematics, finance, and philanthropy have earned him numerous accolades and recognition. Some of the key awards and honors he has received include:

- The Veblen Prize in Geometry (1976): Awarded for his outstanding contributions to the field of differential geometry.

- The American Mathematical Society's Leroy P. Steele Prize for Lifetime Achievement (2014): Recognizing his significant and lasting impact on mathematics.

- Induction into the National Academy of Sciences (2014): A testament to his contributions to both mathematics and finance.

Jim Simons' Influence on Finance

Jim Simons' impact on the financial industry is profound, with his pioneering use of quantitative analysis setting a new standard for investment firms. The success of Renaissance Technologies has inspired numerous other firms to adopt similar data-driven approaches, fundamentally changing the landscape of hedge fund management.

Simons' influence extends beyond his firm, as he has mentored and inspired a new generation of quantitative analysts and financial professionals. His legacy in finance is characterized by innovation, excellence, and a commitment to pushing the boundaries of what is possible.

What is Jim Simons' Legacy?

Jim Simons' legacy is multifaceted, encompassing his achievements in mathematics, finance, and philanthropy. His pioneering work in quantitative finance has transformed the industry, and his philanthropic efforts have made a significant impact on society.

Simons' legacy is defined by:

- Innovation: His work in both mathematics and finance has been characterized by groundbreaking innovation and creativity.

- Philanthropy: Through the Simons Foundation, he has contributed to advancements in education, health, and scientific research.

- Inspiration: Simons continues to inspire future generations, demonstrating the power of applying mathematical principles to real-world challenges.

Frequently Asked Questions

1. How did Jim Simons become so wealthy?

Jim Simons' wealth primarily stems from his success as a hedge fund manager at Renaissance Technologies. His innovative use of quantitative analysis and algorithms has led to exceptional returns, particularly with the Medallion Fund.

2. What makes Renaissance Technologies unique?

Renaissance Technologies is unique due to its reliance on quantitative and data-driven investment strategies, which have consistently outperformed traditional market benchmarks.

3. How has Jim Simons contributed to mathematics?

Jim Simons has made significant contributions to differential geometry, particularly through his work with the Chern-Simons theory, which has had a lasting impact on both mathematics and theoretical physics.

4. What are some of Jim Simons' philanthropic initiatives?

Through the Simons Foundation, Jim Simons has supported initiatives such as the Simons Foundation Autism Research Initiative (SFARI), Math for America, and numerous educational and research programs.

5. Is Jim Simons still involved with Renaissance Technologies?

Jim Simons retired from active management at Renaissance Technologies in 2009, but he remains involved as a non-executive chairman and continues to influence the firm's direction.

6. What is the Chern-Simons theory?

The Chern-Simons theory is a mathematical framework developed by Jim Simons and Shiing-Shen Chern, which has applications in both mathematics and theoretical physics, particularly in the study of three-dimensional manifolds.

Conclusion

Jim Simons' net worth is a testament to his extraordinary success in both mathematics and finance. As a pioneer of quantitative analysis, he has revolutionized the financial industry and inspired countless others. Beyond his financial achievements, Simons' philanthropic efforts have made a lasting impact on education, health, and scientific research. His legacy is one of innovation, generosity, and a relentless pursuit of excellence, ensuring that his influence will be felt for generations to come.

![Jim Simons Net Worth Career, Lifestyle & Charity [2024 Update]](/images/funniest/Jim-Simons-Net-Worth-Career-Lifestyle-Charity-2024-Update.jpg)