In today's unpredictable world, having a financial safety net is more important than ever. American emergency funds are designed to provide individuals and families with the stability they need during unexpected financial crises. From job loss to medical emergencies, these funds can make a significant difference in maintaining financial security. As we delve into the various aspects of American emergency funds, it's essential to understand how they operate and the benefits they offer.

American emergency fund reviews provide valuable insights into how these funds can be an essential part of one's financial planning. With an increasing number of people recognizing their importance, understanding the nuances of these funds is crucial. Reviews often highlight the diverse strategies and approaches individuals take to build and maintain these funds, offering lessons that can be beneficial for both beginners and seasoned savers.

Whether you're just starting your financial journey or looking to enhance your existing strategies, learning from American emergency fund reviews can offer practical guidance. This comprehensive exploration will cover everything from establishing an initial fund to maintaining it over time. By focusing on the experiences and insights shared by others, you can better position yourself for financial resilience and peace of mind.

Read also:Jlo Drama The Intriguing World Of Jennifer Lopezs Life

Table of Contents

- What is an Emergency Fund?

- Importance of Emergency Funds

- How to Start an Emergency Fund?

- Building Your Emergency Fund

- Common Mistakes to Avoid

- American Emergency Fund Reviews

- Strategies for Growing Your Fund

- How Much Should You Save?

- Where to Keep Your Emergency Fund?

- Emergency Fund vs. Investments

- Role of Financial Advisors

- Impact of Inflation on Emergency Funds

- Emergency Fund and Peace of Mind

- Frequently Asked Questions

- Conclusion

What is an Emergency Fund?

An emergency fund is a reserve of money set aside to cover unexpected expenses or financial emergencies. These can range from sudden medical bills, car repairs, or even job loss. The primary purpose of an emergency fund is to provide a financial cushion that prevents the need to rely on high-interest debt, such as credit cards or personal loans, during times of crisis.

By maintaining a dedicated fund, individuals can ensure that they have immediate access to cash without disrupting their regular financial plans. This proactive approach to managing finances can significantly reduce stress and provide a sense of security, knowing that one is prepared for unforeseen circumstances.

Importance of Emergency Funds

The importance of emergency funds cannot be overstated. They play a critical role in financial planning and stability. Here are some key reasons why having an emergency fund is essential:

- Financial Security: Emergency funds offer a safety net that prevents financial ruin in the face of unexpected expenses.

- Debt Avoidance: By having readily available funds, individuals can avoid accruing high-interest debt.

- Peace of Mind: Knowing that you are financially prepared for emergencies provides peace of mind and reduces stress.

- Flexibility: Emergency funds give individuals the flexibility to make decisions without the immediate pressure of financial constraints.

Furthermore, having an emergency fund aligns with sound financial practices, allowing individuals to focus on long-term goals without the anxiety of unexpected financial setbacks.

How to Start an Emergency Fund?

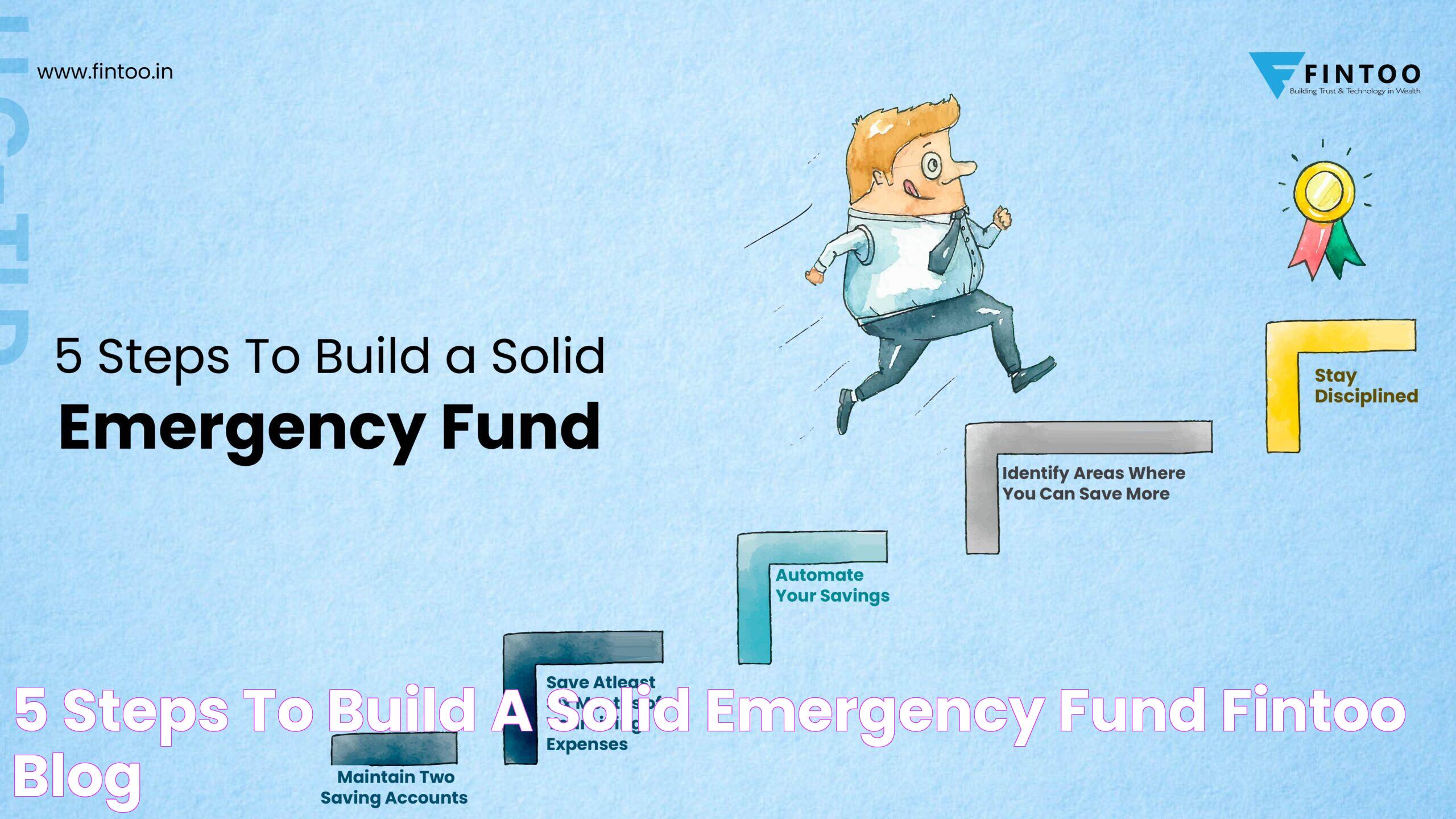

Starting an emergency fund may seem daunting, but with careful planning and discipline, it is achievable. Here are some practical steps to help you get started:

- Set a Goal: Determine how much money you need based on your monthly expenses. A common recommendation is to aim for three to six months of living expenses.

- Create a Budget: Analyze your income and expenses to identify areas where you can cut back and allocate savings towards your fund.

- Open a Separate Account: To avoid the temptation to spend, open a separate savings account specifically for your emergency fund.

- Automate Savings: Set up automatic transfers from your checking account to your emergency fund to ensure consistent contributions.

- Review and Adjust: Regularly review your fund and adjust your savings goals as your financial situation changes.

By following these steps, you can gradually build a robust emergency fund that meets your financial needs.

Read also:Mastering The Art Of Syncing How To Sync Roku Remote To Tv With Ease

Building Your Emergency Fund

Building an emergency fund requires commitment and patience. Once you've initiated your fund, the next step is to focus on its growth. Here are strategies to effectively build your fund:

- Incremental Contributions: Start small and gradually increase your contributions as your financial situation improves.

- Windfalls and Bonuses: Allocate a portion of any unexpected income, such as tax refunds or bonuses, to your emergency fund.

- Cut Unnecessary Expenses: Identify and eliminate non-essential expenses to free up more money for savings.

- Side Income: Consider taking on a part-time job or gig work to boost your savings efforts.

Building a substantial emergency fund takes time, but with persistence and smart financial practices, you can achieve your savings goals.

Common Mistakes to Avoid

While building an emergency fund, it's important to avoid common pitfalls that can impede your progress. Here are some mistakes to watch out for:

- Underestimating Expenses: Failing to account for all potential expenses can lead to an insufficient fund.

- Not Prioritizing Savings: Treat your emergency fund contributions as a non-negotiable part of your budget.

- Using the Fund for Non-Emergencies: Reserve your fund strictly for genuine emergencies, not for planned expenses or splurges.

- Neglecting to Replenish: After using your fund, prioritize replenishing it to maintain your financial safety net.

By being aware of these mistakes, you can ensure that your emergency fund remains a reliable resource when you need it most.

American Emergency Fund Reviews

American emergency fund reviews provide invaluable insights from real-life experiences, highlighting the importance of having a financial safety net. These reviews often discuss the various strategies individuals use to build and maintain their funds, offering a wealth of knowledge for anyone looking to enhance their financial security.

Many reviewers emphasize the peace of mind that comes with having a well-funded emergency reserve. They share stories of how their funds have helped them navigate unexpected expenses without falling into debt. Additionally, reviews often provide tips on effective saving techniques, such as automating contributions and prioritizing savings in personal budgets.

By learning from these reviews, individuals can gain practical insights and inspiration to build their emergency funds, ensuring they are prepared for any financial surprises that life may throw their way.

Strategies for Growing Your Fund

Once you've established the foundation of your emergency fund, the focus shifts to growing it to a sufficient size. Here are some strategies to consider:

- Regular Review: Periodically review your fund's progress and adjust your contributions as needed.

- Increase Contributions: As your income grows, increase the amount you save each month.

- Utilize Savings Tools: Explore savings tools and apps that can help track your progress and keep you motivated.

- Set Milestones: Break your ultimate goal into smaller milestones to make the process more manageable and rewarding.

By implementing these strategies, you can consistently grow your emergency fund, providing a greater sense of financial security over time.

How Much Should You Save?

Determining the right amount to save in your emergency fund depends on various factors, including your monthly expenses, lifestyle, and risk tolerance. Here are some considerations to help you decide:

- Expense Coverage: Aim for three to six months' worth of living expenses as a starting point.

- Job Stability: If your job is less stable, consider saving more to account for potential job loss.

- Family Size: Larger families may require a larger fund to cover additional expenses.

- Debt Levels: High levels of debt may necessitate a larger emergency fund to avoid relying on credit.

Ultimately, the goal is to have enough savings to cover your essential expenses during a financial crisis, giving you time to recover without added stress.

Where to Keep Your Emergency Fund?

Choosing the right place to keep your emergency fund is crucial to ensure its accessibility and safety. Here are some options to consider:

- High-Interest Savings Account: These accounts offer interest on your savings while providing easy access to funds.

- Money Market Account: This option combines the benefits of a savings account with some features of a checking account.

- Certificates of Deposit (CDs): While less liquid, CDs can offer higher interest rates but should be used for a portion of the fund that isn't immediately needed.

Remember, the primary goal is accessibility, so choose an option that allows you to withdraw funds quickly in an emergency.

Emergency Fund vs. Investments

It's important to distinguish between an emergency fund and investments, as both serve different purposes in financial planning. Here are some key differences:

- Liquidity: Emergency funds are highly liquid, allowing quick access during emergencies, while investments may take time to liquidate.

- Risk: Emergency funds are low-risk, stored in safe accounts, whereas investments carry varying levels of risk and potential returns.

- Purpose: Emergency funds are for short-term needs, whereas investments focus on long-term wealth building.

While both are crucial components of a comprehensive financial plan, maintaining a clear distinction between the two ensures that you have resources available for both emergencies and future growth.

Role of Financial Advisors

Financial advisors can play a pivotal role in helping individuals establish and maintain their emergency funds. Here's how they can assist:

- Personalized Guidance: Advisors can assess your financial situation and recommend tailored savings strategies.

- Accountability: Regular meetings with an advisor can help keep you accountable to your savings goals.

- Comprehensive Planning: Advisors can integrate your emergency fund into a broader financial plan that includes investments and retirement savings.

By leveraging the expertise of a financial advisor, you can optimize your approach to building and maintaining your emergency fund, ensuring it aligns with your overall financial objectives.

Impact of Inflation on Emergency Funds

Inflation can erode the purchasing power of your emergency fund over time. Here's how to mitigate its impact:

- Regular Adjustments: Periodically increase your fund contributions to keep pace with inflation.

- Interest-Bearing Accounts: Store your fund in accounts that offer interest, helping to offset inflation's effects.

- Reassess Periodically: Regularly reassess your fund's size to ensure it still covers your living expenses adequately.

By proactively addressing inflation, you can maintain the effectiveness of your emergency fund, ensuring it remains a reliable financial resource.

Emergency Fund and Peace of Mind

Having a well-funded emergency reserve provides unparalleled peace of mind. Here are some ways it contributes to mental and emotional well-being:

- Reduced Stress: Knowing you have a safety net reduces the anxiety associated with potential financial emergencies.

- Confidence in Decision-Making: With an emergency fund, you can make decisions without the immediate pressure of financial constraints.

- Focus on Long-Term Goals: With short-term financial security in place, you can concentrate on achieving long-term objectives.

Ultimately, an emergency fund serves as a foundation for financial stability, allowing individuals to navigate life's uncertainties with greater confidence and peace of mind.

Frequently Asked Questions

What is the ideal size of an emergency fund?

The ideal size of an emergency fund typically ranges from three to six months of living expenses. However, this can vary based on individual circumstances, such as job stability and family size.

How can I start saving for an emergency fund if I have debt?

Even with debt, it's important to start small. Allocate a portion of your budget to both debt repayment and emergency savings, prioritizing high-interest debt first while gradually building your fund.

Can I use my emergency fund for planned expenses?

No, your emergency fund should only be used for unforeseen expenses. Planned expenses should be covered by separate savings plans to avoid depleting your emergency reserve.

What types of accounts are best for emergency funds?

High-interest savings accounts and money market accounts are typically best for emergency funds due to their liquidity and safety.

How often should I review my emergency fund?

It's advisable to review your emergency fund at least annually or whenever there are significant changes in your financial situation, such as a new job or major life event.

Can I invest my emergency fund to earn higher returns?

While it's tempting to seek higher returns, keeping your emergency fund in low-risk, easily accessible accounts is crucial to ensure funds are available when needed without loss.

Conclusion

Building and maintaining an American emergency fund is a critical step toward achieving financial stability and security. By understanding the importance of these funds and learning from American emergency fund reviews, individuals can develop effective strategies to safeguard their financial future. With the right approach, an emergency fund can provide the peace of mind needed to navigate life's uncertainties, allowing for focus on long-term goals and aspirations.

Ultimately, the insights gained from this exploration highlight the significance of proactive financial planning. By incorporating the lessons learned and strategies discussed, readers can take actionable steps to establish a robust emergency fund, ensuring they are well-prepared for any financial surprises that may arise.