Hancock and Whitney Bank has been a pillar of strength and reliability in the financial sector for over a century. Established with a vision to provide top-notch banking services, it has consistently adapted to the changing economic landscape while staying true to its core values. Known for its customer-centric approach, Hancock and Whitney Bank has built a legacy of trust and excellence, serving individuals, businesses, and communities with unparalleled dedication.

Founded in 1899, Hancock and Whitney Bank has grown from its humble beginnings into a prominent financial institution with a robust presence across the Gulf South. With a commitment to fostering economic growth and supporting local communities, the bank has played a pivotal role in the region's development. Its comprehensive range of financial products and services caters to diverse customer needs, making it a preferred choice for many.

As a forward-thinking institution, Hancock and Whitney Bank continuously embraces innovation to enhance its service offerings. By integrating cutting-edge technology and maintaining a keen focus on customer satisfaction, the bank ensures a seamless banking experience for its clients. Whether it's personal banking, business solutions, or wealth management, Hancock and Whitney Bank stands out for its exceptional service and unwavering commitment to its customers.

Read also:The Benefits And Features Of Hiway Credit Union Services

Table of Contents

- History and Evolution of Hancock and Whitney Bank

- What Services Does Hancock and Whitney Bank Offer?

- How Does Hancock and Whitney Bank Support Local Communities?

- The Technology Advancements at Hancock and Whitney Bank

- Why Choose Hancock and Whitney Bank for Personal Banking?

- What Business Solutions Are Available at Hancock and Whitney Bank?

- Wealth Management Services at Hancock and Whitney Bank

- Customer Experience and Satisfaction at Hancock and Whitney Bank

- The Future Vision of Hancock and Whitney Bank

- How Does Hancock and Whitney Bank Ensure Security?

- Corporate Social Responsibility at Hancock and Whitney Bank

- What Sets Hancock and Whitney Bank Apart from Other Banks?

- FAQs

- Conclusion

History and Evolution of Hancock and Whitney Bank

The history of Hancock and Whitney Bank is a testament to its resilience and adaptability in the ever-changing banking landscape. Founded in 1899, the bank initially started as a small local institution in Mississippi. Over the years, it expanded its operations, merging with Whitney Bank in 2011, to become a formidable entity in the Gulf South region. This merger marked a significant milestone, combining the strengths and expertise of both institutions to create a powerhouse in the banking sector.

The bank's growth strategy has always been centered around community engagement and customer satisfaction. Its commitment to maintaining strong relationships with clients has been a driving force behind its success. By staying true to its roots while embracing modern banking practices, Hancock and Whitney Bank have managed to carve a niche for itself in the competitive financial industry.

Throughout its history, Hancock and Whitney Bank have navigated various challenges, including economic downturns and technological shifts. Its ability to adapt and innovate has been critical to its longevity. Today, the bank stands as a symbol of stability and trust, with a legacy that continues to inspire confidence among its stakeholders.

What Services Does Hancock and Whitney Bank Offer?

Hancock and Whitney Bank offers a comprehensive suite of financial services designed to meet the diverse needs of its clients. These services include personal banking, business banking, wealth management, and more. The bank's personal banking services cater to individual needs, offering checking and savings accounts, credit cards, loans, and mortgages. Clients can enjoy seamless banking experiences with features such as online and mobile banking, allowing them to manage their finances conveniently.

For businesses, Hancock and Whitney Bank provides tailored solutions to support growth and operational efficiency. Business banking services include commercial loans, treasury management, business checking accounts, and merchant services. The bank's dedicated team works closely with businesses to understand their unique requirements and provide customized solutions that drive success.

Wealth management services at Hancock and Whitney Bank are designed to help clients achieve their financial goals. Whether it's investment management, estate planning, or retirement solutions, the bank's team of experts offers personalized guidance and strategies to maximize wealth and secure financial futures. The bank's holistic approach ensures clients receive comprehensive support at every stage of their financial journey.

Read also:Decoding The Mystery Of Slug Units A Comprehensive Guide

How Does Hancock and Whitney Bank Support Local Communities?

Hancock and Whitney Bank are deeply committed to supporting the communities it serves. Community engagement and social responsibility are integral to the bank's mission, and it actively participates in initiatives that foster economic development and improve the quality of life for local residents. Through partnerships with nonprofit organizations, educational institutions, and community groups, the bank invests in programs that promote financial literacy, education, and economic empowerment.

The bank's community development efforts include providing financial support and resources to small businesses and entrepreneurs. By offering affordable financing options and business advisory services, Hancock and Whitney Bank help local businesses thrive, creating jobs and stimulating economic growth. The bank also invests in community infrastructure projects, contributing to the development of sustainable and vibrant neighborhoods.

Hancock and Whitney Bank's commitment to community support extends to volunteerism, with employees actively participating in local events and initiatives. The bank encourages its staff to engage in meaningful community service, fostering a culture of giving back and making a positive impact. This dedication to community well-being underscores the bank's role as a responsible corporate citizen and reinforces its reputation as a trusted partner in the Gulf South region.

The Technology Advancements at Hancock and Whitney Bank

In today's digital age, technology plays a crucial role in delivering efficient and secure banking services. Hancock and Whitney Bank have embraced technological advancements to enhance its service offerings and provide a seamless banking experience for its clients. The bank's commitment to innovation is evident in its adoption of cutting-edge technology, ensuring clients have access to convenient and secure banking solutions.

One of the key technological advancements at Hancock and Whitney Bank is its robust online and mobile banking platform. This platform allows clients to manage their accounts, make transactions, and access various banking services from the comfort of their homes or on the go. The user-friendly interface and advanced security features ensure a safe and efficient banking experience.

Furthermore, Hancock and Whitney Bank leverage data analytics and artificial intelligence to gain insights into customer behavior and preferences. This data-driven approach enables the bank to offer personalized services and targeted solutions that meet the specific needs of its clients. By staying ahead of technological trends, Hancock and Whitney Bank continue to enhance its service delivery and maintain its competitive edge in the banking industry.

Why Choose Hancock and Whitney Bank for Personal Banking?

Choosing a bank for personal banking needs is a crucial decision, and Hancock and Whitney Bank stand out as an excellent choice for several reasons. The bank's commitment to customer satisfaction, comprehensive range of services, and personalized approach make it a preferred option for individuals seeking reliable banking solutions.

Hancock and Whitney Bank offers a variety of personal banking products tailored to meet the diverse needs of its clients. Whether you're looking for a checking account with no monthly fees, a high-yield savings account, or a mortgage with competitive rates, the bank has options to suit your financial goals. The bank's experienced team provides personalized guidance, ensuring clients make informed decisions and achieve their financial objectives.

Additionally, Hancock and Whitney Bank's focus on technology ensures a seamless banking experience for its clients. The bank's online and mobile banking platforms offer convenience and accessibility, allowing clients to manage their finances with ease. With a strong emphasis on security and customer support, Hancock and Whitney Bank provide peace of mind and a superior banking experience for personal banking clients.

What Business Solutions Are Available at Hancock and Whitney Bank?

Hancock and Whitney Bank offer a range of business solutions designed to support businesses of all sizes and industries. The bank's comprehensive suite of business banking services includes commercial loans, treasury management, business checking accounts, and merchant services, among others. These solutions are tailored to meet the unique needs of each business, ensuring operational efficiency and financial success.

One of the key offerings for businesses at Hancock and Whitney Bank is its commercial loans and financing solutions. Whether it's a small business loan, equipment financing, or a line of credit, the bank provides flexible financing options to support business growth and expansion. The bank's team of experts works closely with businesses to understand their financial needs and provide customized solutions that drive success.

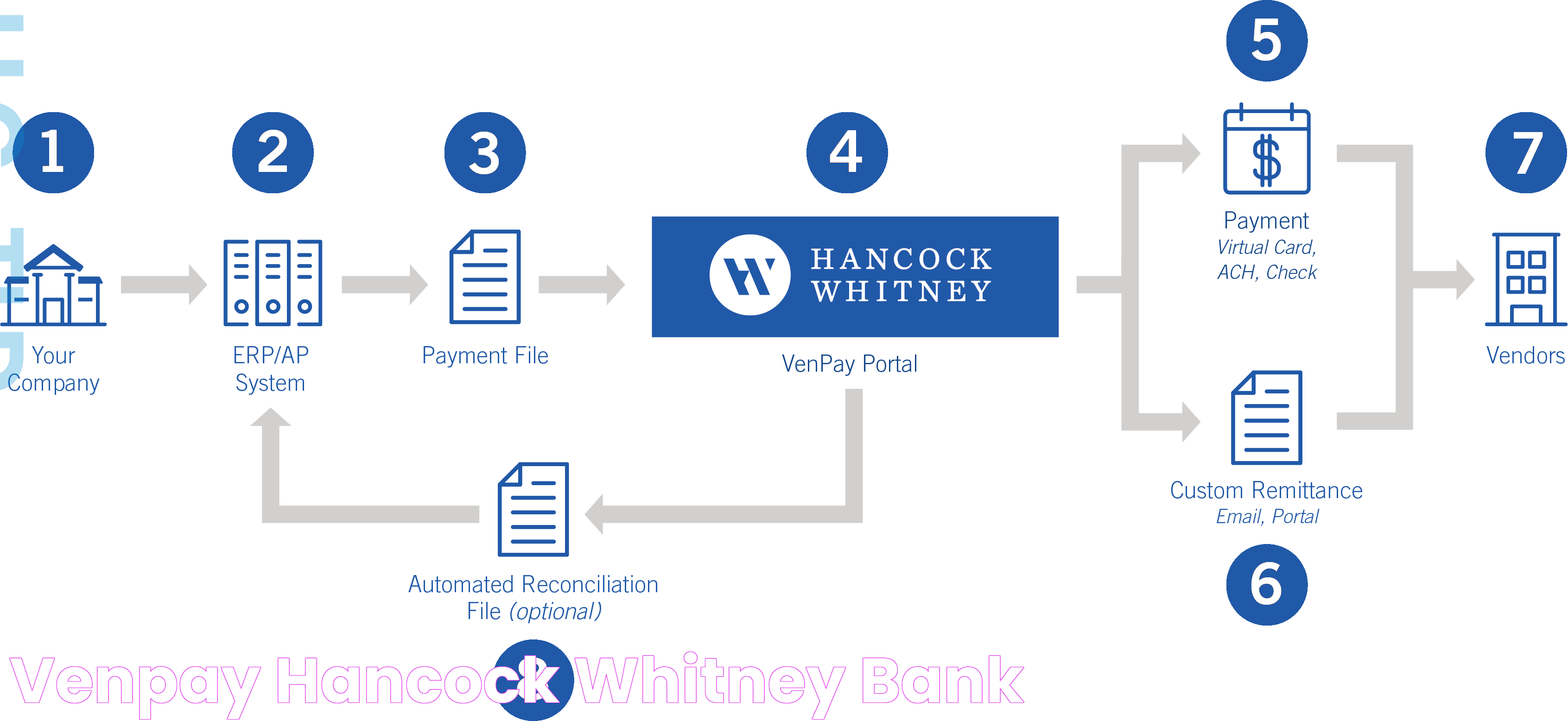

In addition to financing, Hancock and Whitney Bank offer treasury management services to optimize cash flow and streamline financial operations. The bank's suite of treasury management solutions includes cash management, payment processing, and fraud prevention services, among others. These services are designed to enhance efficiency, reduce costs, and mitigate risks, allowing businesses to focus on their core operations and achieve their strategic goals.

Wealth Management Services at Hancock and Whitney Bank

Hancock and Whitney Bank's wealth management services are designed to help clients achieve their financial goals and secure their financial futures. The bank's team of experts offers personalized guidance and strategies to maximize wealth and optimize financial outcomes. Whether it's investment management, estate planning, or retirement solutions, Hancock and Whitney Bank provide comprehensive support to meet the unique needs of each client.

The bank's investment management services include portfolio management, asset allocation, and risk management strategies. The bank's team of experienced advisors works closely with clients to develop customized investment plans that align with their financial goals and risk tolerance. By leveraging market insights and research, Hancock and Whitney Bank aim to deliver optimal investment performance and enhance wealth accumulation.

In addition to investment management, Hancock and Whitney Bank offer estate planning services to help clients protect their assets and plan for the future. The bank's team of experts provides guidance on tax-efficient strategies, wealth transfer, and charitable giving, ensuring clients have a comprehensive plan in place to preserve their legacy and achieve their financial objectives.

Customer Experience and Satisfaction at Hancock and Whitney Bank

Customer experience and satisfaction are at the heart of Hancock and Whitney Bank's mission. The bank is committed to providing exceptional service and building long-lasting relationships with its clients. By prioritizing customer needs and delivering personalized solutions, Hancock and Whitney Bank consistently exceed client expectations and enhance customer satisfaction.

The bank's customer-centric approach is evident in its dedication to understanding and addressing the unique needs of each client. Whether it's personal banking, business solutions, or wealth management, Hancock and Whitney Bank offer tailored services that align with client goals and preferences. The bank's team of experts provides personalized guidance and support, ensuring a positive banking experience for every client.

In addition to personalized service, Hancock and Whitney Bank leverage technology to enhance customer experience. The bank's online and mobile banking platforms offer convenience and accessibility, allowing clients to manage their finances with ease. The user-friendly interface and advanced security features ensure a seamless banking experience, further enhancing client satisfaction and loyalty.

The Future Vision of Hancock and Whitney Bank

Hancock and Whitney Bank's vision for the future is centered around growth, innovation, and community engagement. The bank is committed to expanding its reach and enhancing its service offerings to meet the evolving needs of its clients. By embracing technological advancements and fostering a culture of innovation, Hancock and Whitney Bank aim to remain at the forefront of the banking industry and deliver exceptional value to its stakeholders.

The bank's growth strategy includes expanding its presence in key markets and exploring new business opportunities. By leveraging its strengths and expertise, Hancock and Whitney Bank aim to strengthen its position as a leading financial institution in the Gulf South region. The bank's focus on strategic partnerships and collaborations also plays a crucial role in its growth and expansion plans.

Community engagement and social responsibility continue to be central to Hancock and Whitney Bank's vision for the future. The bank is committed to supporting local communities and investing in initiatives that promote economic development and social well-being. By maintaining strong relationships with community partners and stakeholders, Hancock and Whitney Bank aim to make a positive impact and contribute to the prosperity of the regions it serves.

How Does Hancock and Whitney Bank Ensure Security?

Security is a top priority for Hancock and Whitney Bank, and the institution takes extensive measures to protect the financial information and assets of its clients. The bank employs advanced security technologies and protocols to ensure the highest level of protection against unauthorized access and cyber threats. Clients can trust Hancock and Whitney Bank to safeguard their financial data and provide a secure banking environment.

One of the key security measures employed by Hancock and Whitney Bank is the use of encryption and multi-factor authentication. These technologies protect sensitive information and ensure that only authorized individuals can access accounts and perform transactions. The bank also implements regular security audits and assessments to identify and address potential vulnerabilities, maintaining a robust security posture.

In addition to technological measures, Hancock and Whitney Bank provide clients with resources and guidance on best practices for online security. The bank educates clients on how to recognize and prevent fraud, ensuring they are equipped to protect their financial information. This proactive approach to security underscores Hancock and Whitney Bank's commitment to providing a safe and secure banking experience for its clients.

Corporate Social Responsibility at Hancock and Whitney Bank

Corporate social responsibility (CSR) is a fundamental aspect of Hancock and Whitney Bank's business philosophy. The bank is committed to making a positive impact on the communities it serves and promoting sustainable practices that benefit society and the environment. Through various CSR initiatives, Hancock and Whitney Bank aim to create lasting change and contribute to the well-being of its stakeholders.

The bank's CSR efforts focus on several key areas, including community development, environmental sustainability, and financial literacy. Hancock and Whitney Bank actively participate in initiatives that support local businesses, enhance education, and promote economic empowerment. The bank's investment in community infrastructure projects and partnerships with nonprofit organizations highlight its dedication to fostering sustainable development and improving the quality of life for local residents.

Environmental sustainability is another important aspect of Hancock and Whitney Bank's CSR strategy. The bank is committed to reducing its environmental footprint and promoting eco-friendly practices. By implementing energy-efficient technologies and sustainable business practices, Hancock and Whitney Bank aim to minimize its impact on the environment and contribute to a healthier planet.

What Sets Hancock and Whitney Bank Apart from Other Banks?

Several factors set Hancock and Whitney Bank apart from other financial institutions, making it a preferred choice for individuals and businesses alike. The bank's commitment to customer satisfaction, community engagement, and innovation distinguishes it as a leader in the banking industry.

One of the key differentiators of Hancock and Whitney Bank is its customer-centric approach. The bank prioritizes the needs and preferences of its clients, offering personalized solutions that align with their financial goals. Whether it's personal banking, business solutions, or wealth management, Hancock and Whitney Bank provides tailored services and expert guidance, ensuring a positive banking experience for every client.

Community engagement is another aspect that sets Hancock and Whitney Bank apart. The bank's dedication to supporting local communities and promoting economic development underscores its role as a responsible corporate citizen. Through various community initiatives and partnerships, Hancock and Whitney Bank make a positive impact and contribute to the prosperity of the regions it serves.

FAQs

What is the history of Hancock and Whitney Bank?

Hancock and Whitney Bank was founded in 1899 and has grown from a small local institution into a prominent financial entity in the Gulf South region. Its merger with Whitney Bank in 2011 marked a significant milestone in its history.

What services does Hancock and Whitney Bank offer?

The bank offers a comprehensive range of services, including personal banking, business banking, and wealth management. Clients can access checking and savings accounts, loans, credit cards, investment management, and more.

How does Hancock and Whitney Bank support local communities?

Hancock and Whitney Bank support local communities through partnerships with nonprofit organizations, educational institutions, and community groups. The bank invests in programs that promote economic development, education, and financial literacy.

How does Hancock and Whitney Bank ensure security?

The bank employs advanced security technologies, including encryption and multi-factor authentication, to protect client information. Regular security audits and educational resources further enhance security measures.

What makes Hancock and Whitney Bank's customer service unique?

Hancock and Whitney Bank's customer service is distinguished by its personalized approach and commitment to customer satisfaction. The bank's team of experts provides tailored solutions and guidance to meet the unique needs of each client.

What is Hancock and Whitney Bank's vision for the future?

The bank's vision for the future is centered around growth, innovation, and community engagement. It aims to expand its reach, embrace technological advancements, and support local communities through various initiatives.

Conclusion

Hancock and Whitney Bank's legacy of trust, excellence, and community engagement makes it a trusted financial institution in the Gulf South region. With a comprehensive range of services, a commitment to innovation, and a customer-centric approach, the bank consistently exceeds client expectations and contributes to the prosperity of the communities it serves. As it continues to grow and evolve, Hancock and Whitney Bank remain dedicated to delivering exceptional value and making a positive impact on society.