The GameStop Corporation, commonly known by its stock symbol GME, has been at the center of one of the most intriguing stock market events in recent history. The GME share price has experienced unprecedented volatility, capturing the attention of both seasoned investors and the general public alike. This phenomenon has sparked discussions about market dynamics, retail investor influence, and the role of social media in stock trading.

In recent years, the GME share price has become a symbol of the power of retail investors, driven by social media platforms like Reddit's WallStreetBets. This grassroots movement has challenged the traditional norms of investing, leading to dramatic fluctuations in the stock's value. The volatility has not only affected GameStop but has also raised questions about the future of stock trading and regulatory oversight.

Understanding the factors that contribute to the GME share price's volatility is crucial for investors looking to navigate this complex landscape. This article delves into the history of GameStop, the factors influencing its stock price, and the implications of its volatile nature. By examining these aspects, we aim to provide a comprehensive overview of what drives the GME share price and how investors can make informed decisions in this ever-changing market.

Read also:Nutritional Value Of Tapioca Balls Health Benefits And More

Table of Contents

- History of GameStop: From Brick-and-Mortar to Internet Sensation

- What Factors Impact GME Share Price?

- How Do Social Media Platforms Influence GME Share Price?

- The Role of Retail Investors in GME Share Price

- Impact of Short Selling on GME Share Price

- How Does Market Regulation Affect GME Share Price?

- GME Share Price and the Future of Stock Trading

- Lessons Learned from GME Share Price Volatility

- What Can Investors Do to Navigate GME Share Price Fluctuations?

- Frequently Asked Questions

- Conclusion

History of GameStop: From Brick-and-Mortar to Internet Sensation

GameStop's journey from a small electronics retailer to a household name in the stock market is nothing short of remarkable. Founded in 1984 as Babbage's, the company initially focused on selling software for personal computers. Over the years, GameStop expanded its offerings to include video games, consoles, and related accessories. By the early 2000s, the company had established itself as a leading brick-and-mortar retailer in the gaming industry.

However, the rise of digital downloads and online shopping posed significant challenges to GameStop's business model. As consumers increasingly opted for digital purchases, GameStop faced declining sales and profitability. In response, the company began to explore new strategies to remain competitive, such as expanding its e-commerce capabilities and diversifying its product offerings.

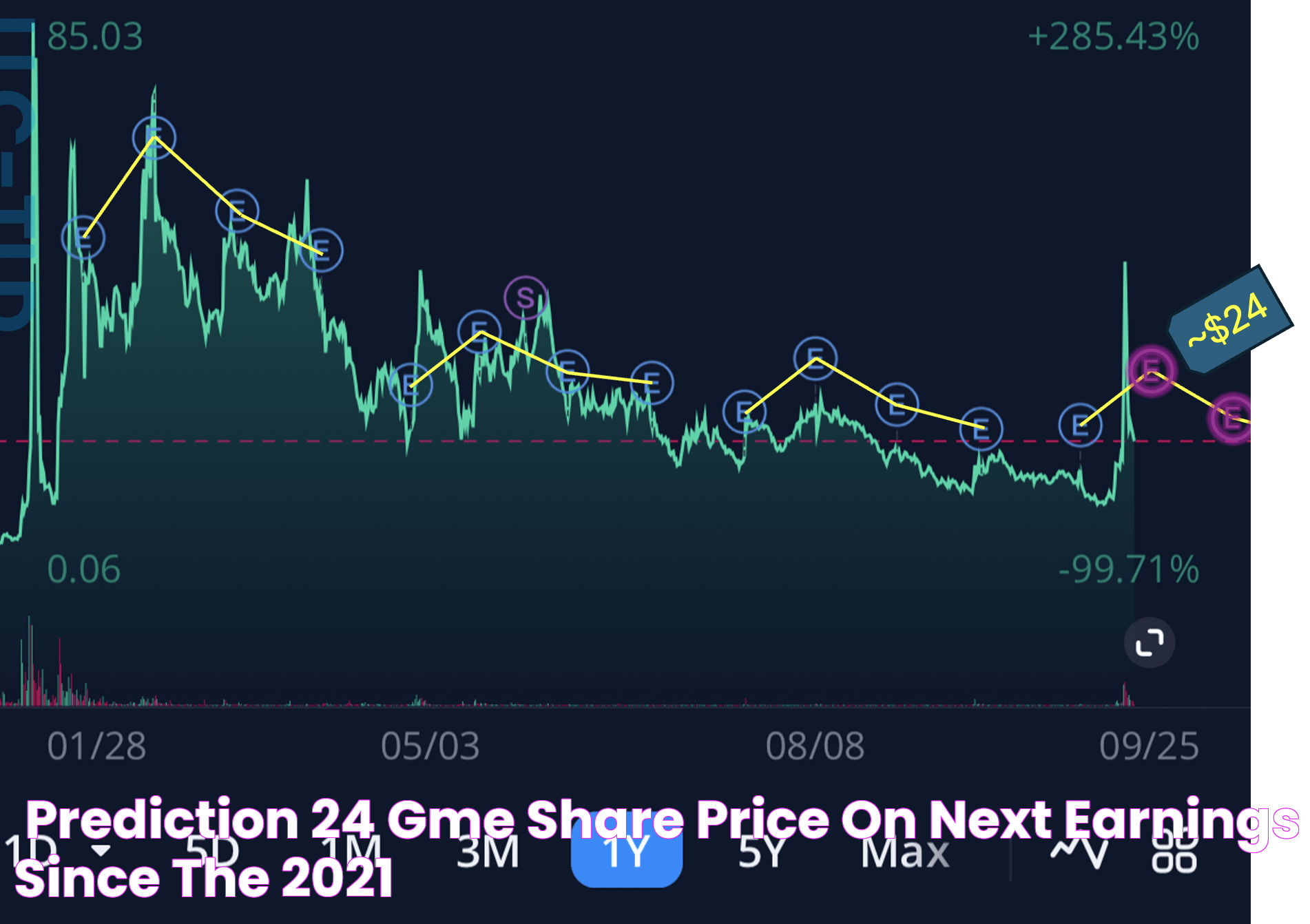

The turning point for GameStop came in 2020 when a group of retail investors on Reddit's WallStreetBets forum identified the stock as undervalued and heavily shorted by institutional investors. This realization sparked a buying frenzy, leading to a massive surge in the GME share price. The event attracted widespread media attention and highlighted the power of retail investors in influencing stock prices.

What Factors Impact GME Share Price?

Several factors contribute to the fluctuations in the GME share price, making it a complex and dynamic stock to analyze. Understanding these factors is essential for investors looking to make informed decisions about their investments in GameStop. Some of the key factors influencing the GME share price include:

- Market Sentiment: Investor sentiment plays a significant role in driving the GME share price. Positive news or rumors about the company can lead to increased buying activity, while negative news can result in selling pressure.

- Short Interest: The level of short interest in GameStop's stock can impact its price. High short interest often leads to short squeezes, where short sellers are forced to buy back shares at higher prices, driving the stock price up.

- Company Performance: GameStop's financial performance, including revenue, earnings, and growth prospects, can influence its share price. Investors closely monitor the company's quarterly reports for insights into its business health.

- Industry Trends: Trends in the gaming and retail industries, such as the shift towards digital gaming and e-commerce, can affect GameStop's business and, consequently, its share price.

- Regulatory Developments: Changes in market regulations or government policies can impact the GME share price. For example, increased scrutiny of retail trading practices or short-selling activities could influence investor behavior.

By analyzing these factors, investors can gain a better understanding of the forces driving the GME share price and make informed decisions about their investments.

How Do Social Media Platforms Influence GME Share Price?

Social media platforms have become powerful tools for influencing stock prices, and GameStop is a prime example of this phenomenon. The GME share price's dramatic rise in early 2021 was largely driven by discussions on Reddit's WallStreetBets forum, where retail investors coordinated their efforts to buy the stock and drive up its price.

Read also:Unveiling The Expertise Of Dr J Mercola A Health Advocates Journey

These platforms allow investors to share information, discuss strategies, and rally support for specific stocks. The viral nature of social media means that news and opinions can spread rapidly, leading to swift changes in investor sentiment and stock prices. This democratization of information has empowered retail investors, giving them a voice in the stock market that was previously dominated by institutional players.

However, the influence of social media on stock prices also raises concerns about market volatility and the potential for misinformation to spread. Regulators are increasingly scrutinizing the impact of social media on trading activities, and there is ongoing debate about how to balance the benefits of open communication with the need for market stability.

The Role of Retail Investors in GME Share Price

Retail investors have played a pivotal role in shaping the GME share price, challenging the traditional power dynamics of the stock market. The rise of online trading platforms like Robinhood has made it easier for individual investors to participate in the market, leading to increased retail participation in stocks like GameStop.

The collective actions of retail investors have demonstrated their ability to influence stock prices, often in ways that defy conventional market logic. This has prompted a reevaluation of the role of retail investors in the financial ecosystem and the impact of their trading activities on market stability.

While the involvement of retail investors in the GME saga has been celebrated as a triumph of the "little guy" over Wall Street, it has also highlighted the need for greater transparency and education in the stock market. Ensuring that retail investors have access to accurate information and understand the risks involved in stock trading is crucial for the long-term health of the market.

Impact of Short Selling on GME Share Price

Short selling has been a significant factor in the volatility of the GME share price. In short selling, investors borrow shares and sell them with the intention of buying them back at a lower price, profiting from the difference. GameStop became a target for short sellers due to its perceived overvaluation and the challenges facing its business model.

The high level of short interest in GME stock set the stage for a short squeeze, where short sellers were forced to buy back shares at higher prices to cover their positions. This buying pressure contributed to the rapid increase in the GME share price, attracting further attention from retail investors and media outlets.

The role of short selling in the GME saga has sparked debates about the ethics and impact of this practice on the market. Some argue that short selling provides valuable market information and liquidity, while others believe it can lead to market manipulation and excessive volatility. Regulatory bodies continue to examine the implications of short selling and consider potential reforms to address these concerns.

How Does Market Regulation Affect GME Share Price?

Market regulation plays a crucial role in shaping the GME share price by influencing trading practices and investor behavior. Regulatory bodies, such as the U.S. Securities and Exchange Commission (SEC), are responsible for ensuring fair and transparent markets while protecting investors from fraud and manipulation.

The GME share price's volatility has prompted regulators to examine the role of retail trading platforms, short selling, and social media in stock trading. Potential regulatory changes could include increased disclosure requirements for short positions, enhanced surveillance of trading activities, and measures to address the spread of misinformation on social media.

While regulation is necessary to maintain market integrity, it is essential to strike a balance that allows for innovation and retail participation without stifling market efficiency. The ongoing dialogue between regulators, investors, and industry stakeholders will shape the future of market regulation and its impact on the GME share price.

GME Share Price and the Future of Stock Trading

The GME share price saga has had profound implications for the future of stock trading, highlighting the growing influence of retail investors and the role of technology in democratizing access to financial markets. The events surrounding GameStop have prompted a reevaluation of traditional market dynamics and the potential for new trading paradigms to emerge.

The rise of retail investors has challenged the dominance of institutional players, emphasizing the importance of accessibility, transparency, and education in the stock market. As technology continues to evolve, investors can expect further innovations in trading platforms, tools, and strategies that cater to a diverse range of participants.

While the GME phenomenon has brought attention to the power of retail investors, it has also underscored the need for responsible investing practices and the importance of understanding the risks involved in stock trading. The lessons learned from GameStop's experience will shape the future of stock trading and the regulatory landscape for years to come.

Lessons Learned from GME Share Price Volatility

The GME share price volatility has provided valuable insights into the dynamics of the stock market and the behavior of investors. Some of the key lessons learned from this experience include:

- The Power of Retail Investors: The collective actions of retail investors have demonstrated their ability to influence stock prices and challenge traditional market norms.

- The Role of Social Media: Social media platforms have become powerful tools for information sharing and coordination among investors, highlighting the need for accurate information and responsible communication.

- The Importance of Regulation: Effective market regulation is essential for maintaining fair and transparent markets while protecting investors from fraud and manipulation.

- The Need for Education: Ensuring that investors have access to accurate information and understand the risks involved in stock trading is crucial for the long-term health of the market.

- Adapting to Change: The evolving landscape of stock trading requires investors, regulators, and industry stakeholders to adapt to new challenges and opportunities.

By reflecting on these lessons, investors can better navigate the complexities of the stock market and make informed decisions about their investments.

What Can Investors Do to Navigate GME Share Price Fluctuations?

Navigating the fluctuations in the GME share price requires a thoughtful approach and a willingness to adapt to changing market conditions. Here are some strategies that investors can consider:

- Stay Informed: Keep up with the latest news and developments related to GameStop, the gaming industry, and the broader stock market.

- Diversify Your Portfolio: Diversification can help mitigate risks by spreading investments across different assets and sectors.

- Set Realistic Goals: Establish clear investment objectives and risk tolerance levels to guide your decision-making process.

- Practice Patience: Avoid making impulsive decisions based on short-term market fluctuations and focus on long-term investment strategies.

- Consult a Financial Advisor: Seek professional advice to gain insights into market trends and develop a personalized investment plan.

By adopting these strategies, investors can better navigate the complexities of the GME share price and make informed decisions to achieve their financial goals.

Frequently Asked Questions

What caused the initial surge in the GME share price?

The initial surge in the GME share price was driven by retail investors on Reddit's WallStreetBets forum, who identified the stock as undervalued and heavily shorted. This led to a buying frenzy and a significant increase in the stock's price.

How has social media influenced the GME share price?

Social media platforms, particularly Reddit, played a crucial role in influencing the GME share price by facilitating information sharing and coordination among retail investors. This led to increased buying activity and significant fluctuations in the stock's price.

What role do retail investors play in the stock market?

Retail investors have gained prominence in the stock market by using online trading platforms and social media to influence stock prices. Their collective actions have challenged traditional market dynamics and emphasized the importance of accessibility and transparency.

How can investors manage risks associated with the GME share price?

Investors can manage risks by staying informed, diversifying their portfolios, setting realistic goals, practicing patience, and consulting financial advisors. These strategies can help mitigate risks and navigate market fluctuations effectively.

What regulatory changes could impact the GME share price?

Potential regulatory changes could include increased disclosure requirements for short positions, enhanced surveillance of trading activities, and measures to address misinformation on social media. These changes could impact investor behavior and the GME share price.

What lessons can be learned from the GME share price volatility?

The volatility of the GME share price highlights the power of retail investors, the influence of social media, the importance of regulation, the need for investor education, and the necessity of adapting to changing market conditions.

Conclusion

The GME share price has become a symbol of the evolving dynamics of the stock market, driven by the influence of retail investors and social media. Understanding the factors that contribute to its volatility is essential for investors looking to navigate this complex landscape. By reflecting on the lessons learned from the GameStop experience, investors can better position themselves to make informed decisions and adapt to the changing nature of stock trading.

As the market continues to evolve, the future of stock trading will be shaped by the interplay between retail investors, institutional players, technology, and regulation. By staying informed and adopting responsible investing practices, investors can successfully navigate the challenges and opportunities presented by the GME share price and the broader financial markets.