Rounding to the nearest cent is a fundamental mathematical skill that we often overlook in our daily transactions. Whether you're handling money, calculating taxes, or analyzing financial data, an understanding of rounding methods is essential. It's not just about getting a close approximation; it's about accuracy and precision in financial matters. By mastering the art of rounding to the nearest cent, you can ensure your calculations are always on point and your financial records are crystal clear.

In today's fast-paced world, where digital transactions and instant payments are the norms, the ability to round numbers efficiently can save both time and money. Imagine not having to second-guess your calculations when balancing your checkbook or preparing your taxes. It's a skill that can bring peace of mind and confidence in your financial decisions. This article aims to equip you with the knowledge and techniques necessary to master rounding, so you can apply it to real-world scenarios with ease.

Throughout this comprehensive guide, we will explore various aspects of rounding to the nearest cent, from its mathematical principles to practical applications. We'll delve into different rounding techniques, discuss common pitfalls, and answer frequently asked questions to ensure you have a well-rounded understanding. So, whether you're a student, a professional, or anyone interested in improving their financial literacy, this article is designed to provide valuable insights and guidance. Let's get started on the journey to mastering rounding!

Read also:Mastering The Concept Of Relative Speed A Comprehensive Guide

Table of Contents

- Biography of Rounding

- Why is Rounding Important?

- Mathematical Principles of Rounding

- Different Rounding Techniques

- How to Round to the Nearest Cent?

- Common Pitfalls in Rounding

- Rounding in Financial Transactions

- Rounding in Taxation

- Tools and Calculators for Rounding

- Rounding in the Digital Age

- Educational Aspects of Rounding

- Frequently Asked Questions

- Conclusion

Biography of Rounding

Rounding has a rich history that dates back to ancient civilizations. The concept of rounding numbers was first introduced by the Babylonians, who used rounding to approximate square roots and other calculations. Over the centuries, rounding evolved as a mathematical concept and became an integral part of arithmetic and number theory.

In modern times, rounding is widely used in various fields, including finance, science, and engineering. It helps in simplifying complex calculations and ensures that numerical results are easy to interpret and communicate. The development of calculators and computers has further enhanced the precision and efficiency of rounding techniques, allowing for more accurate and reliable computations.

Why is Rounding Important?

Rounding is important for several reasons. It simplifies calculations, making them easier to understand and communicate. In financial transactions, rounding ensures that monetary values are accurately represented, preventing errors that could lead to financial discrepancies.

Moreover, rounding is crucial in situations where exact values are not necessary, and an approximate value is sufficient. For instance, when estimating travel expenses or budgeting for a project, rounding helps in creating a more manageable and realistic financial plan.

Mathematical Principles of Rounding

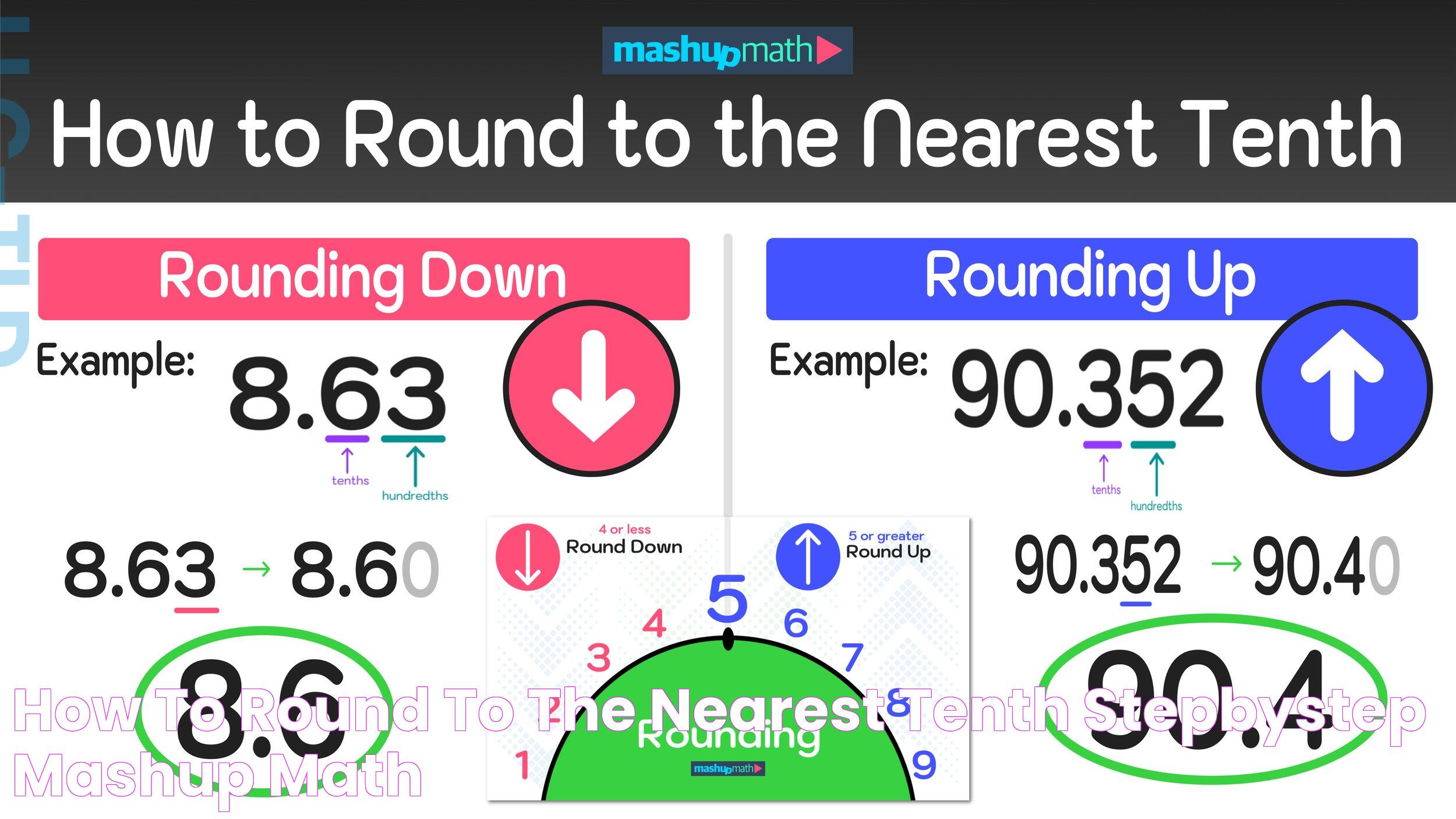

The mathematical principles of rounding are based on the idea of approximating a number to a specified degree of accuracy. The most common rounding method is to round to the nearest whole number, but rounding to the nearest cent is also widely used, especially in financial contexts.

When rounding to the nearest cent, the key principle is to look at the digit in the tenths place (the first digit after the decimal point). If this digit is 5 or greater, the digit in the hundredths place (the second digit after the decimal point) is increased by 1. If the digit in the tenths place is less than 5, the digit in the hundredths place remains unchanged.

Read also:Ultimate Guide To The Best Chickfila Breakfast A Morning Delight

Different Rounding Techniques

There are various rounding techniques, each with its own set of rules and applications. Some of the most common techniques include:

- Round Half Up: This technique rounds numbers up if the digit after the rounding digit is 5 or greater.

- Round Half Down: This technique rounds numbers down if the digit after the rounding digit is 5 or less.

- Round Half Even: Also known as banker's rounding, this technique rounds numbers to the nearest even number when the digit after the rounding digit is 5.

- Round Half Odd: This technique rounds numbers to the nearest odd number when the digit after the rounding digit is 5.

- Truncate: This technique simply removes all digits after the rounding digit without rounding up or down.

How to Round to the Nearest Cent?

Rounding to the nearest cent is a straightforward process. Follow these steps to ensure accuracy:

- Identify the digit in the hundredths place, which represents cents.

- Look at the digit in the thousandths place (the third digit after the decimal point).

- If the thousandths digit is 5 or greater, increase the hundredths digit by 1.

- If the thousandths digit is less than 5, leave the hundredths digit unchanged.

- Eliminate any digits after the hundredths place.

By following these steps, you can accurately round any number to the nearest cent, ensuring precision in your financial calculations.

Common Pitfalls in Rounding

Despite its simplicity, rounding can lead to errors if not done correctly. Some common pitfalls include:

- Rounding too early in a series of calculations, which can lead to inaccurate results.

- Forgetting to apply rounding consistently, resulting in inconsistent outcomes.

- Using the wrong rounding technique for a given situation, leading to incorrect approximations.

To avoid these pitfalls, it is important to understand the rules and principles of rounding and to apply them consistently in your calculations.

Rounding in Financial Transactions

Rounding is an essential aspect of financial transactions, ensuring that monetary values are accurately represented and communicated. In retail, for example, prices are often rounded to the nearest cent to simplify transactions and make them more consumer-friendly.

Furthermore, rounding is used in accounting to simplify financial statements and reports. It helps in presenting figures in a clear and concise manner, making it easier for stakeholders to understand the financial health of a business.

Rounding in Taxation

In taxation, rounding plays a crucial role in calculating tax liabilities and credits. Tax authorities often require that tax amounts be rounded to the nearest dollar or cent to ensure consistency and accuracy in tax reporting.

Rounding also helps in simplifying tax calculations, making it easier for taxpayers to determine their tax obligations and for tax authorities to process tax returns efficiently.

Tools and Calculators for Rounding

There are numerous tools and calculators available that can help with rounding calculations. These tools are designed to simplify the rounding process and ensure accuracy in your calculations. Some popular options include:

- Online Rounding Calculators: These calculators allow you to input a number and specify the rounding method, providing accurate results instantly.

- Spreadsheet Software: Programs like Microsoft Excel and Google Sheets have built-in rounding functions that can automate the rounding process.

- Financial Software: Many financial software programs include rounding features to assist with financial calculations and reporting.

Rounding in the Digital Age

In the digital age, rounding has become more important than ever. With the rise of digital transactions and automated systems, accurate rounding is essential to ensure that financial data is correctly processed and recorded.

Digital payment systems, for example, rely on rounding to ensure that transactions are processed smoothly and efficiently. This is especially important in situations where small discrepancies could lead to significant errors or financial losses.

Educational Aspects of Rounding

Rounding is a fundamental mathematical skill that is taught in schools as part of the mathematics curriculum. It helps students develop a strong foundation in number theory and arithmetic, preparing them for more advanced mathematical concepts.

Additionally, rounding is an important skill for financial literacy, helping students understand the importance of accuracy and precision in financial calculations and decision-making.

Frequently Asked Questions

What is the purpose of rounding numbers?

Rounding numbers simplifies calculations, making them easier to understand and communicate. It ensures accuracy in financial transactions and helps in creating realistic financial plans.

How does rounding affect financial transactions?

Rounding ensures that monetary values are accurately represented, preventing errors that could lead to financial discrepancies. It simplifies financial statements and reports, making them easier to interpret.

What are the different rounding techniques?

Common rounding techniques include Round Half Up, Round Half Down, Round Half Even, Round Half Odd, and Truncate. Each technique has its own set of rules and applications.

How can I avoid rounding errors?

To avoid rounding errors, apply rounding consistently in your calculations and use the appropriate rounding technique for a given situation. Avoid rounding too early in a series of calculations.

Are there tools available for rounding calculations?

Yes, there are numerous tools and calculators available that can help with rounding calculations. These include online rounding calculators, spreadsheet software, and financial software programs.

Why is rounding important in the digital age?

In the digital age, accurate rounding is essential to ensure that financial data is correctly processed and recorded. It ensures smooth and efficient processing of digital transactions.

Conclusion

Rounding to the nearest cent is an essential skill that plays a crucial role in financial transactions, taxation, and digital systems. By mastering the art of rounding, you can ensure accuracy and precision in your calculations, making informed financial decisions with confidence. Whether you're a student, a professional, or anyone interested in improving your financial literacy, understanding rounding techniques and principles is invaluable. With the knowledge and insights provided in this guide, you're well-equipped to navigate the world of rounding and apply it to real-world scenarios with ease.