In recent years, the world of cryptocurrency has been buzzing with various innovations, and one such phenomenon making waves is airdrops crypto. Airdrops have become a popular method for blockchain projects to distribute tokens directly to the wallets of users, often for free. This strategic move not only helps in raising awareness about a new cryptocurrency but also aids in building a robust community around it. As the crypto market continues to evolve, understanding airdrops becomes crucial for both seasoned investors and newcomers alike.

Essentially, airdrops crypto is a marketing tactic used by blockchain projects to reward early adopters or engage new users. By distributing free tokens, projects can achieve multiple goals such as increasing the token’s circulation, encouraging user participation, and expanding their user base. While the concept might sound straightforward, the process of receiving airdrops involves several steps and requirements that participants must be aware of to capitalize on these opportunities fully.

With the increasing popularity of airdrops, it becomes vital for crypto enthusiasts to stay informed about the latest trends and best practices. This comprehensive guide aims to delve into the world of airdrops crypto, exploring its mechanics, benefits, potential risks, and future prospects. By the end of this article, readers will have a thorough understanding of airdrops and how to navigate this exciting facet of the cryptocurrency landscape.

Read also:Insights Into Use For My Talent Drama Zu Yan And Junjies Impact

Table of Contents

- What Are Airdrops?

- How Do Airdrops Work?

- Types of Airdrops

- Benefits of Airdrops

- How to Participate in Airdrops?

- Popular Airdrops in the Crypto World

- Airdrops vs ICOs: What's the Difference?

- Potential Risks of Airdrops

- Legal Aspects of Airdrops

- What Does the Future Hold for Airdrops?

- Frequently Asked Questions

- Conclusion

What Are Airdrops?

Airdrops in the cryptocurrency context refer to the distribution of tokens or coins to numerous wallet addresses. This is often done for free or as a reward for performing certain tasks. The primary goal of airdrops is to promote the project and increase the ownership of the token among potential users. By distributing tokens widely, projects aim to create a buzz and develop a community of users who can help in the project’s growth.

There are two main types of airdrops: standard and exclusive. Standard airdrops are often open to everyone who meets specific requirements, such as holding a certain cryptocurrency in their wallet. Exclusive airdrops, on the other hand, are limited to a select group of people, such as early supporters or participants in previous events related to the project.

In many cases, airdrops are used as a way to reward loyal users and attract new ones. They can be an effective marketing strategy, allowing projects to gain visibility in a crowded market. However, not all airdrops are legitimate, and it’s crucial for participants to be cautious and do their research before engaging in any airdrop.

How Do Airdrops Work?

The process of participating in an airdrop typically starts with meeting specific criteria set by the project team. These criteria might include holding a certain amount of a specific cryptocurrency, joining the project’s community on social media, or completing tasks such as sharing posts or referring friends.

Once the criteria are met, participants usually need to register their wallet address with the project. This is necessary so that the project can distribute the tokens to the correct wallets. After registration, the project team will conduct the airdrop, and the tokens will be sent to the participants’ wallets.

It’s important to note that while some airdrops are automatic, others require participants to manually claim their tokens. This might involve connecting their wallet to the project’s platform or performing additional tasks. Participants should always follow the instructions provided by the project to ensure they receive their tokens.

Read also:Khal Drigo The Charismatic Leader And His Enduring Influence

Types of Airdrops

Airdrops can be classified into several types, each with its own unique characteristics and requirements. Understanding these types can help participants identify the opportunities that best suit their interests and investment strategies.

Standard Airdrops

Standard airdrops are open to a wide range of participants and typically require minimal effort to join. These airdrops often involve simple tasks such as signing up for a newsletter or following the project on social media. In some cases, participants might need to hold a specific cryptocurrency in their wallet at the time of the airdrop.

Exclusive Airdrops

Exclusive airdrops are limited to a select group of participants, such as early supporters or individuals who have previously participated in the project’s events. These airdrops are designed to reward loyal users and create a sense of community among the project’s supporters.

Bounty Airdrops

Bounty airdrops involve participants completing specific tasks in exchange for tokens. These tasks can range from creating content about the project to referring friends or translating materials into different languages. Bounty airdrops are often used to promote the project and increase its visibility in the market.

Holder Airdrops

Holder airdrops are distributed to participants who hold a specific cryptocurrency in their wallet at the time of the airdrop. The amount of tokens received is usually proportional to the number of coins held by the participant. Holder airdrops are designed to reward loyal investors and encourage long-term holding of the project’s token.

Benefits of Airdrops

Airdrops offer several benefits for both projects and participants. For projects, airdrops can serve as an effective marketing tool, helping to increase awareness and attract new users. By distributing tokens to a large number of participants, projects can create a buzz and gain visibility in a crowded market.

For participants, airdrops provide an opportunity to receive free tokens, which can potentially increase in value over time. This can be an attractive proposition for both new and experienced investors, as it allows them to diversify their portfolios without spending any money.

In addition to the potential financial gains, airdrops can also serve as a way for participants to learn more about new projects and technologies. By engaging with a project through an airdrop, participants can gain insights into the project’s goals and vision, as well as the broader cryptocurrency landscape.

How to Participate in Airdrops?

Participating in airdrops can be a straightforward process if participants follow a few simple steps. Here’s a guide on how to get started:

- Research: Before participating in any airdrop, it’s important to research the project thoroughly. Look for information about the team, the project’s goals, and its roadmap. This will help you determine whether the project is legitimate and worth your time.

- Meet the Requirements: Most airdrops have specific requirements that participants must meet. This might include holding a certain cryptocurrency in your wallet, joining the project’s community on social media, or completing specific tasks. Make sure you understand the requirements and can fulfill them before participating.

- Register Your Wallet: Once you’ve met the requirements, you’ll need to register your wallet address with the project. This is necessary so that the project can distribute the tokens to your wallet. Make sure you provide the correct wallet address to avoid losing your tokens.

- Claim Your Tokens: After the airdrop is conducted, you may need to manually claim your tokens. This might involve connecting your wallet to the project’s platform or performing additional tasks. Follow the instructions provided by the project to ensure you receive your tokens.

By following these steps, participants can successfully engage in airdrops and take advantage of the opportunities they offer.

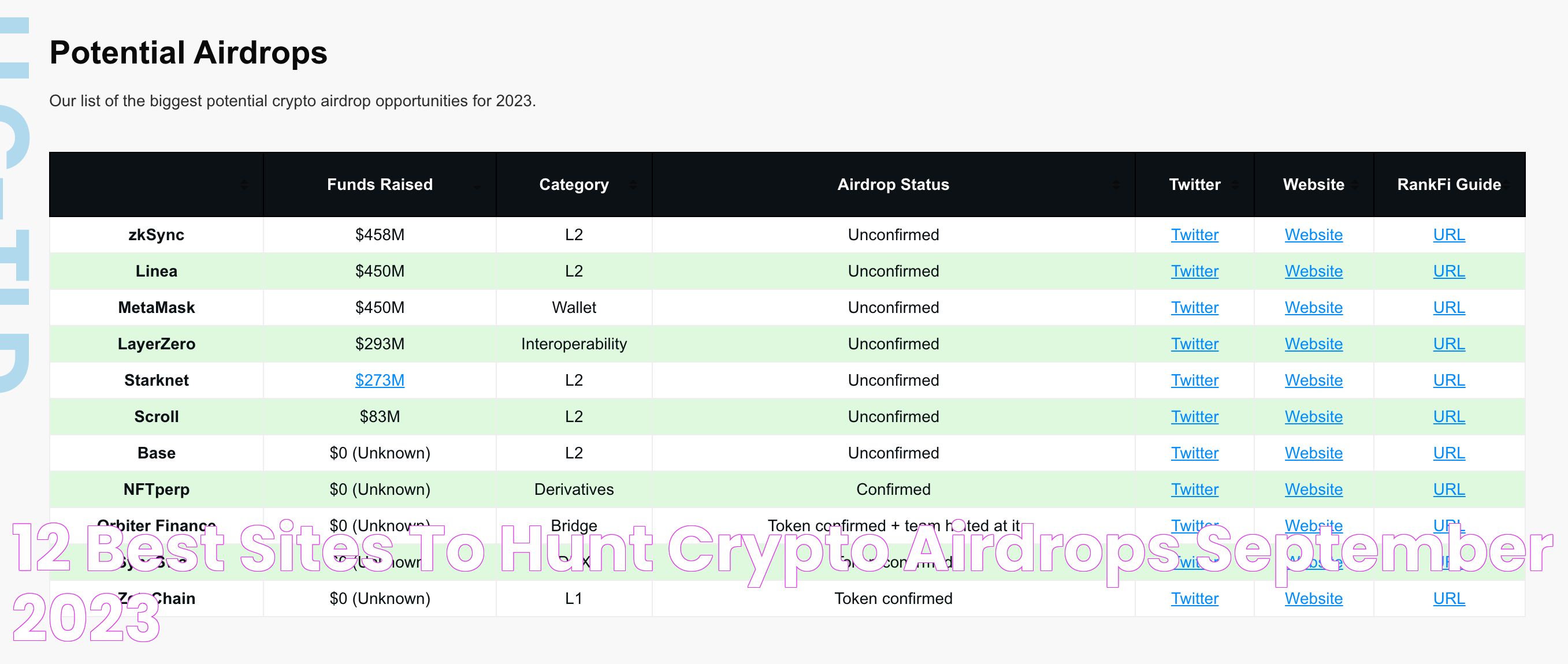

Popular Airdrops in the Crypto World

Several airdrops have gained popularity in the crypto world due to their success and the value they have provided to participants. Here are some notable examples:

Uniswap (UNI) Airdrop

In September 2020, Uniswap, a decentralized exchange, conducted one of the most famous airdrops in crypto history. The project distributed 400 UNI tokens to every wallet that had interacted with the platform before a specific date. This airdrop not only rewarded early users but also boosted Uniswap’s visibility and user base.

Stellar (XLM) Airdrop

Stellar, a blockchain platform designed for fast and low-cost cross-border transactions, has conducted several airdrops to promote its XLM token. One of the largest airdrops took place in 2018, when Stellar distributed 2 billion XLM tokens to users of the Blockchain.com wallet.

Bitcoin Cash (BCH) Airdrop

Bitcoin Cash, a fork of Bitcoin, conducted an airdrop for Bitcoin holders following its creation in 2017. Bitcoin holders received an equivalent amount of BCH tokens, allowing them to participate in the new blockchain network. This airdrop was significant in promoting Bitcoin Cash and establishing its user base.

Airdrops vs ICOs: What's the Difference?

While airdrops and Initial Coin Offerings (ICOs) are both methods used by blockchain projects to distribute tokens, they have distinct differences. Understanding these differences can help participants make informed decisions about which opportunities to pursue.

Airdrops

Airdrops involve the free distribution of tokens to a wide audience. The primary goal is to promote the project and increase the token’s circulation. Airdrops are often used as a marketing tool to attract new users and engage existing ones. Participants usually need to meet specific criteria or complete tasks to receive the tokens.

Initial Coin Offerings (ICOs)

ICOs, on the other hand, involve the sale of tokens to raise funds for a project. Participants purchase tokens using cryptocurrencies or fiat currency, and the funds raised are used to develop the project. ICOs are similar to traditional fundraising methods, such as Initial Public Offerings (IPOs), but are conducted in the crypto space.

While airdrops provide free tokens to participants, ICOs require participants to invest in the project. Both methods have their advantages and risks, and participants should carefully evaluate each opportunity before deciding to engage.

Potential Risks of Airdrops

While airdrops can offer several benefits, they also come with potential risks that participants should be aware of. By understanding these risks, participants can take steps to protect themselves and make informed decisions.

Scams and Fraud

One of the most significant risks associated with airdrops is the potential for scams and fraud. Some airdrops are created solely to deceive participants and steal their personal information or funds. To avoid falling victim to scams, participants should always conduct thorough research on the project and verify its legitimacy before participating.

Privacy Concerns

Airdrops often require participants to provide personal information, such as their email address or social media accounts. This can lead to privacy concerns, as participants may be exposed to phishing attacks or spam. To protect their privacy, participants should be cautious about the information they share and use separate accounts for airdrop participation.

Market Volatility

The value of tokens received through airdrops can be highly volatile, and participants may experience significant fluctuations in their value. While some tokens may increase in value over time, others may lose value quickly. Participants should be prepared for this volatility and avoid making investment decisions based solely on the potential value of airdropped tokens.

Legal Aspects of Airdrops

The legal landscape surrounding airdrops is complex and varies by jurisdiction. Participants should be aware of the legal implications of participating in airdrops and ensure they comply with relevant regulations.

Regulatory Compliance

In some jurisdictions, airdrops may be considered a form of securities distribution, subject to regulatory oversight. Projects conducting airdrops should ensure they comply with relevant securities laws and obtain any necessary permits or licenses. Participants should also be aware of the legal requirements in their jurisdiction and ensure they comply with any applicable regulations.

Tax Implications

Airdrops may have tax implications for participants, depending on their jurisdiction. In some cases, participants may be required to report the value of the tokens received as income and pay taxes on any gains realized from selling the tokens. Participants should consult with a tax professional to understand the tax implications of participating in airdrops and ensure they comply with relevant tax laws.

What Does the Future Hold for Airdrops?

The future of airdrops in the cryptocurrency space looks promising, with several trends and developments shaping their evolution. As the crypto market continues to mature, airdrops are likely to become more sophisticated and targeted, offering new opportunities for projects and participants alike.

Increased Regulation

As the crypto market continues to grow, regulatory scrutiny of airdrops is likely to increase. This could lead to stricter compliance requirements for projects conducting airdrops, as well as increased transparency and accountability. While increased regulation may pose challenges for some projects, it could also help to enhance the legitimacy and credibility of airdrops in the market.

Improved Targeting

Future airdrops are likely to become more targeted, focusing on specific user segments and demographics. By tailoring airdrops to the needs and interests of specific groups, projects can increase their effectiveness and achieve better results. This could involve using data analytics and machine learning to identify and engage the most relevant participants.

Integration with DeFi

The integration of airdrops with decentralized finance (DeFi) platforms is another trend to watch. By leveraging DeFi protocols, projects can create new and innovative ways to distribute tokens and engage users. This could involve using smart contracts to automate airdrop distribution, or integrating airdrops with DeFi lending and staking platforms.

Frequently Asked Questions

1. What are airdrops crypto, and how do they work?

Airdrops crypto refers to the distribution of free tokens to users' wallets, often as a marketing strategy to promote a new cryptocurrency. They work by requiring participants to meet certain criteria, such as holding a specific cryptocurrency or completing tasks, to receive tokens.

2. Are airdrops safe to participate in?

While many airdrops are legitimate, there are risks involved, such as scams and privacy concerns. Participants should conduct thorough research and verify the legitimacy of the project before participating in any airdrop.

3. How can I find out about upcoming airdrops?

To stay informed about upcoming airdrops, participants can follow cryptocurrency news websites, join crypto forums and communities, and subscribe to newsletters from reliable sources. Some websites also specialize in listing upcoming airdrops.

4. Do I need to pay taxes on airdropped tokens?

The tax implications of airdropped tokens vary by jurisdiction. Participants may be required to report the value of the tokens received as income and pay taxes on any gains realized from selling the tokens. It's advisable to consult with a tax professional to understand the tax requirements.

5. Can I sell my airdropped tokens immediately?

Yes, participants can sell their airdropped tokens, but it's important to consider market conditions and the token's value before doing so. Some tokens may have lock-up periods or trading restrictions, so participants should be aware of any limitations.

6. What should I do if I suspect an airdrop is a scam?

If you suspect an airdrop is a scam, avoid participating and report it to relevant authorities or platforms. Always prioritize your security and privacy, and only engage with projects that have verified legitimacy.

Conclusion

Airdrops crypto presents an exciting opportunity for both blockchain projects and participants in the cryptocurrency space. By distributing tokens to a wide audience, projects can increase awareness, build a community, and promote their offerings. For participants, airdrops offer a chance to receive free tokens, diversify their portfolios, and learn about new projects.

However, it's essential to approach airdrops with caution, conducting thorough research and understanding the potential risks involved. By staying informed and taking the necessary precautions, participants can make the most of airdrops and navigate the ever-evolving world of cryptocurrency successfully.

As the crypto market continues to develop, airdrops are likely to play an increasingly important role in the ecosystem. By keeping an eye on emerging trends and adapting to new developments, both projects and participants can harness the potential of airdrops to achieve their goals and contribute to the growth of the crypto space.

For further insights and updates on airdrops and other crypto-related topics, consider visiting Cointelegraph, a reliable source for cryptocurrency news and analysis.